The 2025 overtime tax deduction could put thousands of dollars back in your pocket. On July 4, 2025, President Trump signed this benefit into law as part of the One Big Beautiful Bill Act.

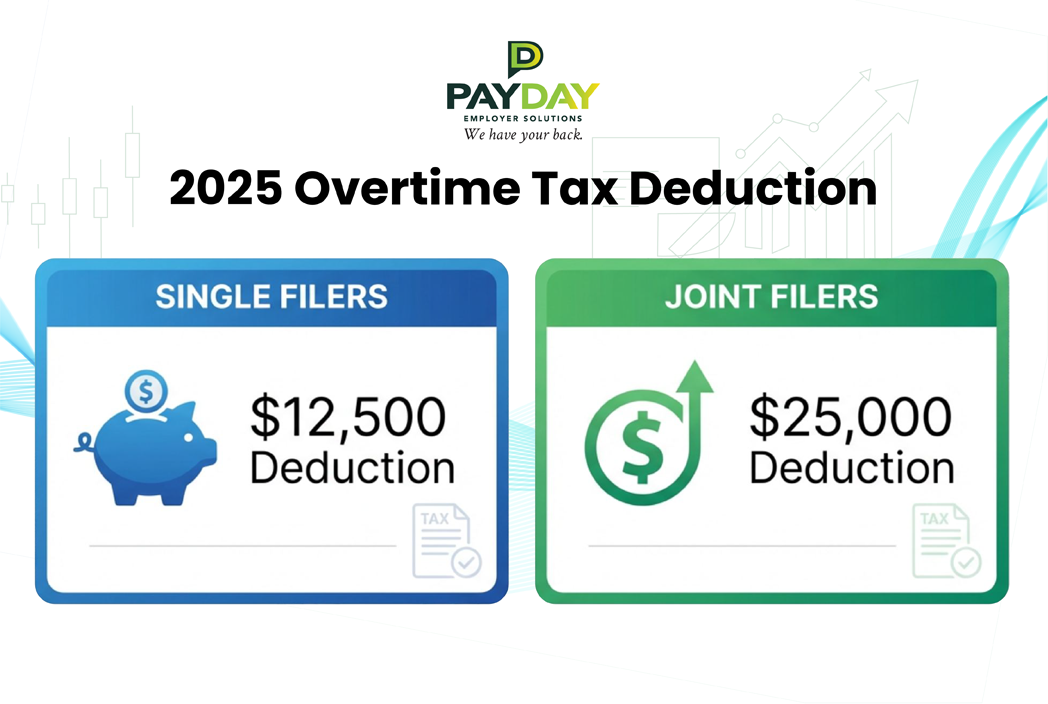

Workers can now deduct up to $12,500 of overtime pay. Joint filers can deduct up to $25,000. However, there’s a catch…your employer isn’t required to break out this information on your W-2.

This guide shows you exactly how to calculate your 2025 overtime tax deduction, what documentation you need, and how to claim every dollar you’ve earned.

Understanding the 2025 Overtime Tax Deduction

This new deduction is what tax professionals call an “above-the-line” deduction. That means it reduces your adjusted gross income before you itemize or take the standard deduction. It’s one of the most valuable deductions available.

How the Deduction Caps Work

The maximum 2025 overtime tax deduction varies by filing status:

- Single filers: $12,500 maximum

- Married filing jointly: $25,000 maximum

- Head of household: $12,500 maximum

These limits don’t apply equally to everyone, though. Income thresholds determine whether you qualify for the full amount.

Income Phase-Out Rules

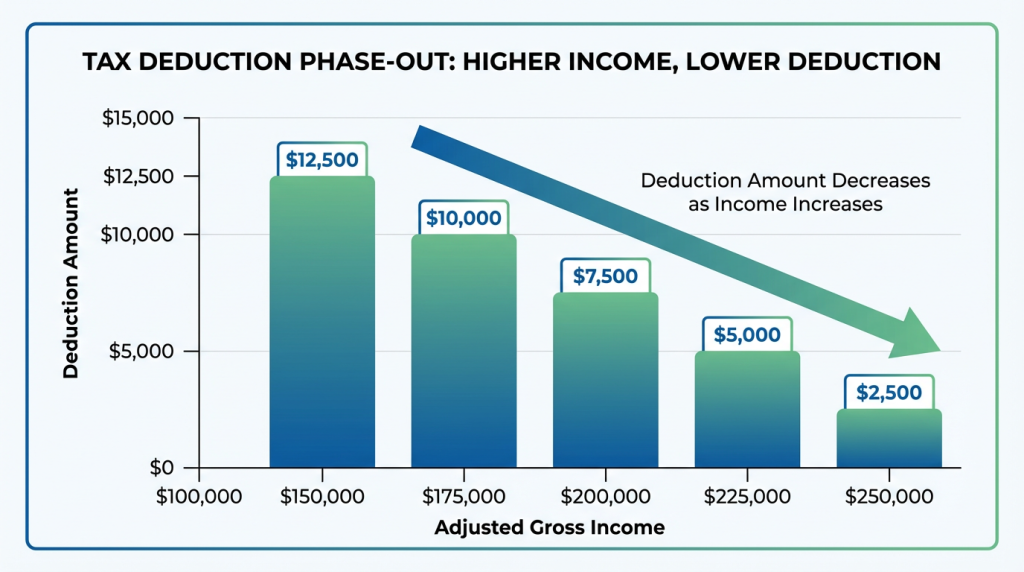

If your adjusted gross income exceeds certain thresholds, your deduction starts to phase out:

- Single filers: Phase-out begins at $150,000

- Joint filers: Phase-out begins at $300,000

The reduction is $100 for every $1,000 over the threshold. For example, a single filer earning $160,000 would see their deduction reduced by $1,000, leaving them with a maximum deduction of $11,500.

The Critical Detail Most People Miss

This deduction only applies to the premium portion of your overtime pay. Under the Fair Labor Standards Act, overtime is paid at time and a half. This deduction covers only that extra “half” portion, not the entire overtime payment.

Additionally, this deduction doesn’t reduce your Social Security taxes, Medicare taxes, or state income taxes. It only affects your federal income tax calculation.

Duration of the Benefit

The 2025 overtime tax deduction applies to tax years 2025 through 2028. Therefore, you have a four-year window to benefit from this break.

Who Qualifies for the 2025 Overtime Tax Deduction

Understanding qualification rules saves you time and prevents potential IRS issues.

You Qualify If:

These requirements are met:

- You received overtime compensation mandated by the Fair Labor Standards Act

- You worked more than 40 hours in a workweek

- Your employer paid you at least time and a half for extra hours

- Your adjusted gross income falls below phase-out thresholds (or you’re only partially phased out)

- You’re a W-2 employee who received this overtime pay during 2025

You Don’t Qualify If:

Any of these situations apply to you:

- Your overtime was paid only under state law requirements that exceed federal FLSA rules

- You have a custom contract providing overtime pay exceeding FLSA requirements (you can only deduct the FLSA-required portion)

- You’re salaried and exempt from FLSA overtime requirements

- You’re self-employed or receive a 1099 form

Important note: Many professional, administrative, and executive employees are exempt from FLSA overtime requirements. Check your employment classification if you’re unsure.

The Documentation Challenge You Need to Solve

Here’s the complication: The IRS provided transition relief to employers. Consequently, your employer isn’t required to separately report the deductible portion of overtime on your W-2 form.

Your W-2 will show your total wages in Box 1, including all overtime pay. However, it won’t break out how much of that overtime qualifies for the 2025 overtime tax deduction.

What This Means for You

The responsibility falls squarely on you to:

- Track your overtime hours and payments

- Calculate the deductible amount

- Maintain proper documentation

- Report the deduction accurately on your tax return

The good news? The math isn’t difficult once you know the formula. The challenge is gathering the right documentation and keeping organized records.

Calculating Your 2025 Overtime Tax Deduction: Step-by-Step

Let’s walk through the process of determining your deduction. You’ll need your paystubs and a calculator.

Step 1: Gather Your Paystubs

Start by collecting every paystub from 2025. If your employer provides a year-end summary or final paystub with annual totals, that’s even better.

Look for these line items:

- “Overtime Pay”

- “OT Pay”

- “Premium Pay”

- Similar overtime descriptions

You need the total amount of overtime compensation you received for the entire year.

Multiple employers? Gather paystubs from each one. You’ll need to track overtime from all sources.

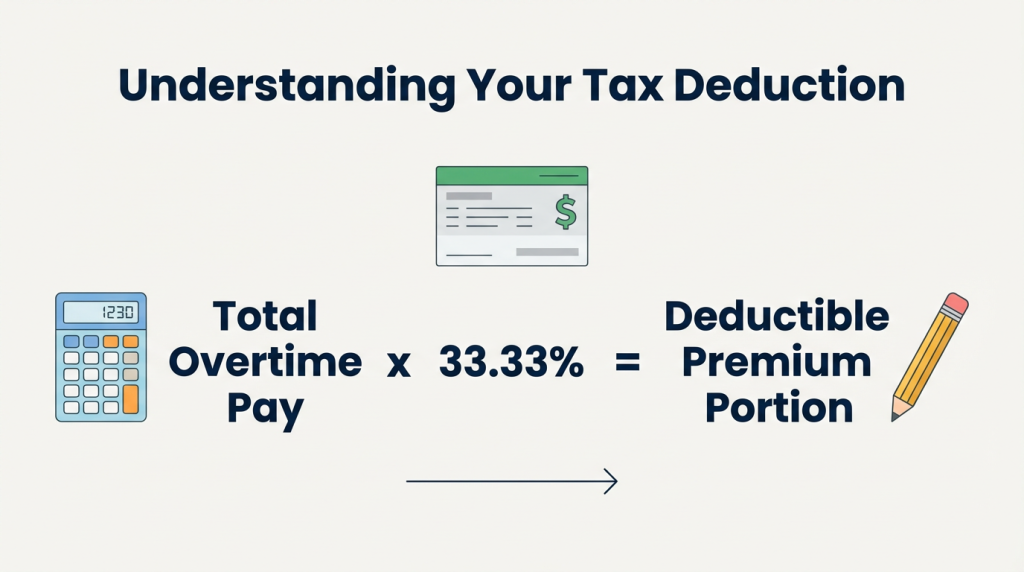

Step 2: Apply the Calculation Formula

Once you have your total overtime pay, calculate the deductible premium portion using this formula:

Total Overtime Pay × 33.33% = Deductible Premium Portion

Alternatively, divide your total overtime pay by 3, since you’re calculating one-third of the total.

Why This Formula Works

When you’re paid time and a half, you receive:

- Your regular rate (100%)

- Plus half your regular rate (50%)

- Total: 150% of your regular rate

The deductible portion is that extra 50%, which represents one-third of the total overtime payment (50% ÷ 150% = 33.33%).

Example Calculation #1

Scenario: You earned $15,000 in total overtime pay during 2025.

Calculation: $15,000 × 0.3333 = $5,000

Result: Your deductible premium portion is $5,000.

Example Calculation #2

Scenario: You earned $30,000 in total overtime pay during 2025.

Calculation: $30,000 × 0.3333 = $10,000

Result: Your deductible amount is $10,000.

Step 3: Compare to Your Cap

Now take your calculated deductible amount and compare it to the maximum allowed for your filing status.

For single filers: Maximum deduction is $12,500

For married filing jointly: Maximum deduction is $25,000

If your calculated amount is less than the cap, you can deduct the full calculated amount. If it’s more, you’re limited to the cap.

Check the Phase-Out

If your adjusted gross income exceeds the threshold, calculate your reduction:

- Determine how much your AGI exceeds the threshold

- Divide that amount by 1,000

- Multiply by 100

- Subtract from your maximum deduction

Example: Single filer with $160,000 AGI

- AGI exceeds threshold by: $160,000 – $150,000 = $10,000

- Divided by 1,000: $10,000 ÷ 1,000 = 10

- Multiplied by 100: 10 × 100 = $1,000

- Reduction: $12,500 – $1,000 = $11,500 maximum deduction

Step 4: Document Everything Properly

Don’t throw away those paystubs after completing your calculation. You need them for your records.

Create a simple spreadsheet showing:

- Each pay period with overtime

- The overtime amount for each period

- Your running total for the year

- Your final calculation methodology

Multiple employers? Create separate calculations for each, then combine for a total.

Keep all documentation with your tax records. While you don’t submit paystubs with your tax return, you need them available if the IRS questions your 2025 overtime tax deduction.

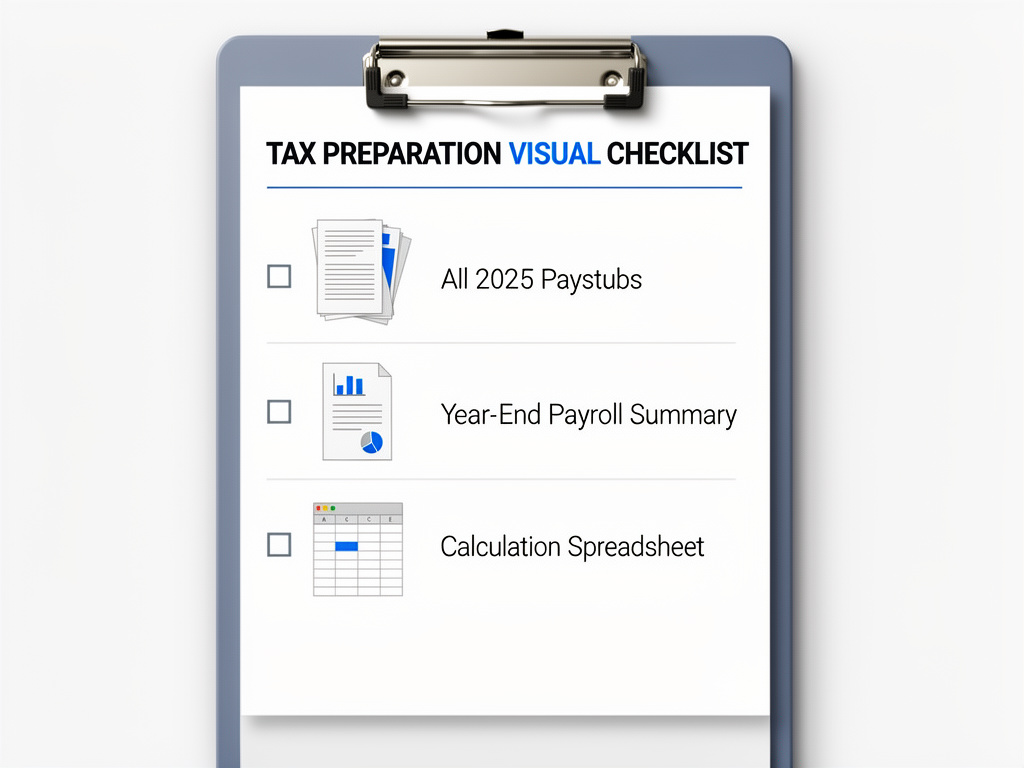

Preparing to Claim Your Deduction

This deduction applies to your 2025 tax return, which you’ll file in early 2026. That gives you time to prepare, but don’t procrastinate.

Before Your Tax Appointment, Gather:

Collect these essential documents:

- All 2025 paystubs showing overtime pay (keep individual stubs even if you have a summary)

- Your final pay statement of 2025 with year-to-date totals

- Any payroll summaries your employer provides

- Your calculation spreadsheet showing how you arrived at your deduction amount

Reach Out to Your Employer

While employers aren’t required to provide this breakdown, many are willing to help. Consider contacting your payroll department and asking for:

- A summary of your 2025 overtime earnings

- Confirmation of your total overtime hours

- Any documentation they can provide

It doesn’t hurt to ask, and it might save you hours of work.

Working With a Tax Professional

When you meet with your tax preparer, bring all documentation and be prepared to explain your calculation. A good tax professional will:

- Verify your math

- Ensure you’re claiming the correct amount

- Check for phase-out reductions

- Confirm your qualification for the deduction

If you prepare your own taxes,use the IRS withholding calculator to understand how the 2025 overtime tax deduction affects your overall tax picture.

Common Questions About the 2025 Overtime Tax Deduction

What if I had multiple jobs with overtime?

Track the overtime from each employer separately using the same calculation method. Then add the deductible amounts together.

Your combined deduction still caps at $12,500 for single filers or $25,000 for joint filers. Additionally, make sure your total adjusted gross income doesn’t push you into the phase-out range.

Does this apply to salaried employees?

Only if you receive FLSA-qualified overtime. Many salaried positions are classified as exempt under FLSA, which means you’re not entitled to overtime pay at all.

However, some salaried employees are non-exempt and do receive overtime. Check your employment classification if you’re unsure about your status.

Will the 2025 overtime tax deduction continue beyond this year?

Yes. The One Big Beautiful Bill Act established this deduction for tax years 2025 through 2028. You’ll be able to claim it for four years total, assuming you continue to earn qualifying overtime.

What if I’m self-employed?

This deduction applies specifically to W-2 employees receiving FLSA-mandated overtime compensation. Self-employed individuals follow different rules for business deductions and compensation.

If you pay yourself through a business entity, consult with a tax professional about how your compensation structure is treated.

How does this interact with other deductions?

Because this is an above-the-line deduction, it reduces your adjusted gross income. That can have positive ripple effects:

- Potentially making you eligible for other income-based tax benefits

- Preventing phase-outs of other deductions

- Reducing your overall tax burden

Moreover, you can claim the 2025 overtime tax deduction whether you itemize or take the standard deduction.

What if my employer made a mistake on my overtime pay?

If you believe your employer didn’t pay you correctly for overtime under FLSA, that’s a separate issue from claiming the tax deduction. You should address payroll errors with your employer or consult the Department of Labor about Fair Labor Standards Act requirements.

For tax purposes, you can only deduct the overtime you actually received, not what you should have received.

Can I amend previous tax returns to claim this deduction?

No. The 2025 overtime tax deduction only applies to tax years 2025 through 2028. It doesn’t apply retroactively to 2024 or earlier years.

What happens if I claim the wrong amount?

If you overstate your deduction, the IRS may:

- Request additional documentation

- Reduce your deduction to the correct amount

- Assess penalties and interest on underpaid taxes

Therefore, it’s crucial to calculate your deduction accurately and maintain proper documentation.

Take Action on Your 2025 Overtime Tax Deduction Now

The 2025 overtime tax deduction represents real money back in your pocket. However, you’ll only benefit if you claim it correctly.

With employers not required to break out this information separately, the responsibility falls on you to track and calculate the deductible amount accurately.

Your Action Plan

Follow these steps to ensure you maximize your deduction:

Right now:

- Gather your 2025 paystubs

- Create your calculation spreadsheet

- Contact your employer’s payroll department for assistance

Before tax season:

- Complete your deduction calculation

- Organize all supporting documentation

- Review the IRS guidelines for any updates

During tax preparation:

- Bring all documentation to your tax professional

- Verify your calculations

- Claim your full deduction amount

Additional Resources

Understanding what’s included in Box 1 of your W-2 has never been more important. The 2025 overtime tax deduction is just one of several significant changes in the One Big Beautiful Bill Act that affects how Americans are taxed on their work.

For more information about payroll compliance and tax optimization, explore our comprehensive resources on the PayDay blog.

Get Expert Help With Your 2025 Overtime Tax Deduction

Have questions about maximizing your overtime deduction or other provisions in the new tax law? Contact PayDay Employer Solutions today.

We help both employers and employees navigate these changes and ensure you’re taking advantage of every benefit available to you. Our team stays current on the latest tax law changes so you don’t have to. Don’t leave money on the table. Get expert guidance on claiming your 2025 overtime tax deduction and ensure you receive every dollar you’re entitled to.