Signed into law on July 4, 2025, the One Big Beautiful Bill Act (OBBBA) is one of the most wide-reaching business and labor bills in recent history. It changes how overtime is taxed, introduces new tip-related deductions, reopens research tax advantages, and updates benefits programs that employers and employees both rely on.

This breakdown covers the core provisions you need to understand. Whether you’re running payroll, planning benefits, or just trying to keep your books clean before tax season, this is the information that matters.

Let’s get into it.

Overtime Pay Just Got a Tax Break. But Not for Everyone.

What is Overtime?

Overtime is any time worked beyond 40 hours in a week, and under federal law (the Fair Labor Standards Act or FLSA), it must be paid at time and a half.

If an employee earns $20/hour, overtime hours must be paid at $30/hour. It’s a protection designed to reward extra effort and prevent overwork.

What the OBBBA changed:

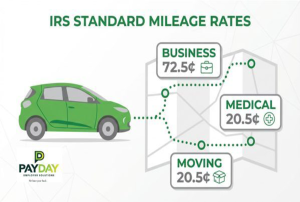

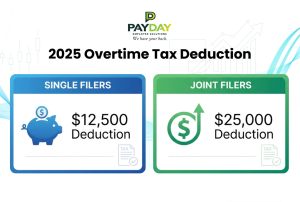

Now, employees who earn overtime under FLSA rules can deduct up to $12,500 of that overtime income from their taxable income. For joint filers, the deduction goes up to $25,000.

But there’s a catch:

- The deduction only applies to federally mandated overtime, not state overtime or privately negotiated contracts.

- If your AGI is above $150,000 (or $300,000 jointly), the deduction starts to phase out by $100 for every $1,000 over the limit.

This applies for tax years 2025 through 2028.

What employers should do:

- Keep clean, detailed records of all FLSA-qualified overtime

- Separate any state-based or bonus-style overtime from federal overtime

- Inform employees that the overtime they earn could now lower their taxes

How OBBBA Reshapes Tip Income Tax Breaks

What counts as Tip Income?

Tips are voluntary payments given by a customer, usually in recognition of good service. Think restaurants, salons, valet services or any place where someone might say “keep the change.”

The IRS treats tips as taxable income, and workers are required to report them.

What the OBBBA changed:

Employees can now deduct up to $25,000 in qualified tip income from their taxable income. But not all tips count.

To qualify, a tip must be:

- Voluntarily paid by the customer

- Not built into the bill or a required service charge

- Not negotiated in advance

- Possibly pooled or shared with other team members

Also, to qualify, the worker must have been employed in a tip-earning role before December 31, 2024.

Just like the overtime rule, there’s a phaseout for high earners (starts at $150,000 AGI or $300,000 jointly).

Industries excluded from claiming the tip deduction include:

- Law

- Finance

- Accounting

- Performing arts

- Athletics

- Healthcare

Self-employed individuals can deduct tips too but only up to the amount of their gross income.

What employers should do:

- Train your team on how to distinguish “qualified tips” from other payments

- Keep clear records of tip reporting

- Make sure payroll and HR systems can flag eligible workers for 2025 through 2028

OBBBA Restores Full Deductibility of R&D Expenses

What is R&D?

R&D (Research and Development) refers to the work businesses do when they’re creating something new or improving how they operate. That could be a new product, a more efficient process, or even a better way to deliver a service.

If your business spends money experimenting, prototyping, testing, or developing. You’re likely doing R&D.

And here’s the good news: the government wants to reward you for it.

What the OBBBA changed:

Before 2022, businesses could deduct 100 percent of R&D expenses in the same year they were spent. That changed and for a while, companies had to spread that deduction over several years.

The OBBBA reverses that. Now, if your R&D is done in the U.S., you can fully deduct those costs in the same tax year again.

If the R&D was performed outside the U.S., you’ll still need to amortize it over fifteen years.

And if you’re a small business with under $31 million in average annual receipts, you can amend your past tax returns (2022 to 2024) to claim the benefit retroactively.

What employers should do:

Make sure your financial team is tagging R&D expenses properly. If you’ve invested in innovation, there may be money waiting for you in your past filings.

Big Shifts for HSAs and Dependent Care FSAs

What is an HSA?

An HSA (Health Savings Account) is a special account you can use to save money tax-free and spend it tax-free on medical expenses.

To qualify, you need to be enrolled in a High Deductible Health Plan (HDHP). Which typically has lower premiums but higher out-of-pocket costs. The upside? You can put aside money, let it grow, and use it for things like prescriptions, co-pays, or even dental work.

What is a Dependent Care FSA?

A Dependent Care Flexible Spending Account (FSA) lets you set aside pre-tax dollars to pay for childcare or elder care.

Think daycare, summer camp, after-school care, or care for a dependent adult. The money goes in before taxes, which means you save. Sometimes hundreds or thousands of dollars a year.

What’s new under OBBBA:

For HSAs:

- Bronze and Catastrophic plans from the insurance exchange are now HSA-eligible

- You can use up to $150/month for Direct Primary Care (DPC), or $300/month for families

- The temporary telehealth exception is now extended, meaning your plan can waive the deductible for virtual care and still let you contribute to your HSA

For Dependent Care FSAs:

- The annual cap increases from $5,000 to $7,500. The first hike since the 1980s

- But heads-up, it’s a fixed number and not tied to inflation

What employers should do:

Update your benefits guide and onboarding packets. Communicate these changes early during open enrollment, and make sure your HR or payroll team is prepped to handle the updates.

The bill introduces several updates to health-related savings and spending accounts.

Boosted Tax Credit for Paid Family and Medical Leave

What is Paid Family and Medical Leave?

This is time off that employees take for major life events, like having a baby, taking care of a sick parent, or recovering from a serious illness, while still receiving partial pay.

While the U.S. doesn’t have a national mandate for paid leave, many businesses offer it voluntarily.

To support this, the federal government provides a tax credit to companies who offer it.

What the OBBBA changed:

The credit just got better.

- The base credit increases to 40% of wages paid during leave

- For small businesses (with less than $29 million in revenue), the credit increases to 50%

- The annual cap is now $500,000, or $600,000 for small businesses

To qualify, employers must:

- Offer at least two weeks of paid leave

- Pay at least 50% of the employee’s normal wages

- Provide this to full-time workers who’ve been employed for 6+ months

- Have a written policy in place

This version of the credit starts after December 31, 2025

What employers should do:

- Review and update your paid leave policy

- Verify employee eligibility based on tenure and hours

- Talk to your accountant about how to claim the credit properly in 2026

OBBBA Boosts the Child Tax Credit. But Just a Bit

What is the Child Tax Credit?

This is a tax credit that reduces how much you owe if you’re raising kids. It’s designed to offset the cost of childcare, food, clothing, and general life expenses.

It’s partially refundable, which means even if you don’t owe much in taxes, you can still get some of that credit back as a refund.

What the OBBBA changed:

- The credit amount increases from $2,000 to $2,200 per child

- The refundable portion (the part you can get back as cash) increases to $1,700

To qualify:

- The child must be under 17

- They must be listed as a dependent

- They must have a valid Social Security Number

What employers should do:

- While this doesn’t impact your tax obligations as a business, it’s helpful to share updates like this with employees through HR or internal communications

- It can build trust and position your business as one that stays current on things that matter to families

Student Loan Repayment Benefit Becomes Permanent

What is Employer Student Loan Repayment?

This is when an employer helps pay down an employee’s student loan balance. It’s becoming a popular benefit, especially among companies looking to attract younger talent.

Previously, it was a temporary tax-free benefit. Now, it’s permanent.

What the OBBBA changed:

Employers can now contribute up to $5,250 per year toward an employee’s student loan repayment tax-free.

That means:

- The employee doesn’t pay income tax on that amount

- The employer doesn’t pay payroll tax on it either

This applies to federal and private loans.

What employers should do:

- Consider adding student loan repayment as part of your benefits package

- Promote it in job listings and retention strategies

- Coordinate with payroll and HR to handle tax reporting correctly

Other Key Changes for Business Owners

What are Section 179 Expensing and Business Interest Deductions?

These are two big levers for businesses to reduce taxable income:

- Section 179 expensing allows you to write off the full cost of equipment or property you purchase for your business

- Business interest deductions let you deduct the interest you pay on business loans or financing

What the OBBBA changed:

For Section 179:

- Annual expensing cap increased to $2.5 million

- Phase-out threshold increased to $4 million

For Business Interest:

- Reverts to an earlier definition of adjusted taxable income

- You can now add back depreciation, amortization, and depletion, which increases the amount of interest you can deduct

Got questions about how this affects your business or paycheck?

We’re here to help translate the fine print into real-world impact. *******@******es.com?subject=Email%20from%20blog%20article&body=Name:%0D%0ACompany:%0D%0APhone:%0D%0A%0D%0AComments:” target=”_blank” rel=”noreferrer noopener”>Contact us today and let’s make sense of your next move.