Your Strategic Playbook for Flawless Payroll Operations

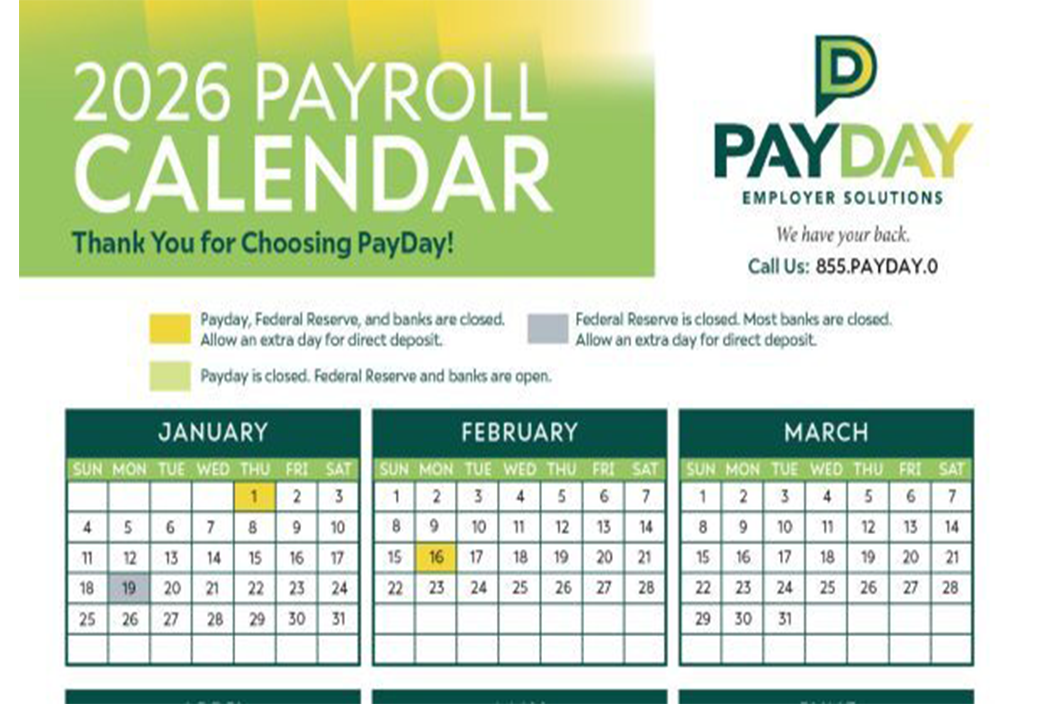

Let’s be honest, payroll mistakes are expensive. Use the 2026 PayDay Employer Solutions Calendar to make sure you don’t miss a single deadline or trigger:

- Late payment penalties from the IRS

- Frustrated employees who depend on predictable paychecks

- Damaged trust that takes months to rebuild

- Administrative chaos as your team scrambles to catch up

The 2026 PayDay ES Payroll Calendar isn’t just a list of dates. It’s a strategic planning tool designed to protect your business, your employees, and your sanity.

What Makes 2026 Unique for Payroll Planning

Holiday Timing Creates Tricky Scenarios

2026 presents several scheduling challenges that demand advance planning:

Independence Day Falls on Saturday

- Observed Friday, July 3rd

- This creates a shortened processing week right when summer vacations peak

Thanksgiving Week Double Closure

- PayDay closed Thursday AND Friday (November 26-27)

- Federal Reserve closed only Thursday

- You’ll need payroll submitted by Wednesday, November 25th for on-time deposits

Christmas Falls on Friday

- Creates potential for extended closures if employees take December 28th off

- Plan December payroll submissions by Wednesday, December 23rd

Complete 2026 Closure Reference Guide

Tier 1: Full Closures in Our Payroll Calendar (PayDay + Federal Reserve + Banks)

These dates require the most advance planning. Submit payroll at least one business day earlier than usual.

| Date | Holiday | Day of Week | Recommended Submission Deadline |

|---|---|---|---|

| January 1 | New Year’s Day | Thursday | December 30, 2025 |

| May 25 | Memorial Day | Monday | Thursday, May 21 |

| July 3 | Independence Day (Observed) | Friday | Wednesday, July 1 |

| September 7 | Labor Day | Monday | Thursday, September 3 |

| November 26 | Thanksgiving | Thursday | Tuesday, November 24 |

| December 25 | Christmas Day | Friday | Wednesday, December 23 |

Tier 2: Banking Closures (Federal Reserve + Most Banks Closed)

PayDay offices remain open, but direct deposits will not process. Plan accordingly.

| Date | Holiday | Day of Week | What You Should Know |

|---|---|---|---|

| January 19 | Martin Luther King Jr. Day | Monday | ACH transactions delayed until Tuesday |

| February 16 | Presidents’ Day | Monday | Some state offices also closed |

| October 12 | Columbus Day | Monday | Not all banks observe—verify with yours |

| November 11 | Veterans Day | Wednesday | Mid-week closure can catch teams off guard |

Tier 3: PayDay-Only Closures

Banks and the Federal Reserve operate normally, but PayDay support is unavailable.

| Date | Holiday | Day of Week | Action Required |

|---|---|---|---|

| April 3 | Good Friday | Friday | Submit questions/issues by Thursday, April 2 |

| November 27 | Day After Thanksgiving | Friday | Self-service portal remains accessible |

Month-by-Month Strategic Planning Guide Using Our Payroll Calendar

Q1: January – March

January

- Start the year strong by auditing your W-2 distribution process.

- MLK Day falls on a Monday—adjust weekly payroll accordingly.

- Key Action: Confirm all employee tax withholding updates are entered.

February

- Presidents’ Day creates a short week for bi-weekly payroll.

- Begin reviewing Q1 tax deposit schedules.

- Key Action: Verify state unemployment rate updates are applied.

March

- No federal holidays observed. Use this month to catch up.

- Key Action: Conduct a mid-quarter compliance check.

Q2: April – June

April

- Check our payroll calendar for Good Friday (PayDay closed)—plan support needs in advance.

- Tax season pressure may affect employee availability.

- Key Action: Ensure Q1 941 filings are submitted on time.

May

- Memorial Day begins summer scheduling challenges.

- Key Action: Communicate submission deadlines to managers before vacation season.

June

- No closures. This is an ideal month to check for process improvements.

- Key Action: Review upcoming July 3rd closure impact on your payroll cycle.

Q3: July – September

July

- Independence Day observed July 3rd (Friday), creating a 4-day week.

- Summer vacations are at their peak. Ensure backup coverage for payroll approvers.

- Key Action: Confirm all approvers have designated alternates.

August

- No closures. Take a minute to catch your breath before fall begins.

- Key Action: Begin planning for Q4 year-end processes.

September

- Labor Day closure hits this month.

- Key Action: Back-to-school staffing changes often require payroll updates.

Q4: October – December

October

- Columbus Day lands this month. Make sure to verify your bank’s observance policy.

- Open enrollment season begins for many organizations.

- Key Action: Prepare systems for benefits deduction changes.

November

- HIGH ALERT: Check our payroll calendar for the two consecutive PayDay closures (26th and 27th).

- This is the most challenging payroll week of the year!

- Key Action: Submit November payroll by Tuesday the 24th at the latest.

December

- Christmas on Friday creates a year-end crunch.

- Key Action: Begin W-2 preparation and verify employee addresses.

Payroll Processing Best Practices for 2026

The 48-Hour Rule

When a closure approaches, submit payroll 48 hours before your normal deadline rather than 24. This buffer accounts for:

- Unexpected system issues

- Last-minute corrections

- Banking processing delays

Build a Closure Communication Plan

Don’t assume your team remembers every holiday. Create a simple notification system:

- Two weeks before – Email reminder to all payroll approvers.

- One week before – Calendar invite blocking the adjusted deadline.

- Two days before – Final confirmation that payroll is submitted.

Designate Backup Payroll Approvers

Vacations and emergencies happen. For every payroll approver, identify:

- A primary backup who can step in same-day.

- A secondary backup for extended absences.

- Clear documentation on approval procedures.

What Happens When You Miss a Payroll Deadline?

Understanding the consequences helps prioritize prevention:

| Scenario | Consequence | Recovery Time |

|---|---|---|

| Missed direct deposit window | Employees paid 1-2 days late | Immediate trust damage |

| Late federal tax deposit | IRS penalties ranging from 2-15% | 30-60 days to resolve |

| Incorrect state filing | State penalties + interest | 60-90 days to resolve |

| W-2 errors discovered post-distribution | W-2c corrections required | 2-4 weeks additional work |

The PayDay ES Calendar exists to prevent every scenario above.

How the 2026 PayDay Employer Solutions Calendar Supports Your Success

We don’t just hand you the 2026 PayDay Employer Solutions calendar and wish you luck. Our team provides:

Proactive Deadline Alerts

- Automated reminders before every closure.

- Custom notifications based on your pay schedule.

Expert Support When You Need It

- Dedicated specialists who understand multi-state complexity.

- Year-end guidance for W-2s, 1099s, and ACA reporting.

Technology That Works for You

- Mobile-friendly payroll approvals.

- Real-time reporting and analytics.

- Seamless integration with leading HR platforms.

Download Your 2026 PayDay Employer Solutions Calendar

Don’t wait until January to get organized. Download the complete 2026 PayDay ES Payroll Calendar today and start planning for a stress-free year.

Ready to simplify your payroll operations? Contact us now to finish strong, stay compliant, and step boldly into 2026.

Your payroll success is our priority. Let’s make 2026 your smoothest year yet.