New Year, New Numbers: Is Your Payroll Ready for 2026?

The calendar just flipped, and our 2026 Tax Facts guide is here to help. With a new year comes significant changes to federal wage bases, retirement limits, and state requirements. Therefore, if you haven’t adjusted your payroll systems yet, now is the time to act.

Whether you’re managing payroll for a small business, overseeing HR operations, or juggling multi-state compliance across the tri-state area, this guide breaks down everything you need to know.

Bookmark this page. Download our 2026 Tax Facts PDF. And breathe a little easier knowing you’ve got the numbers that matter right at your fingertips.

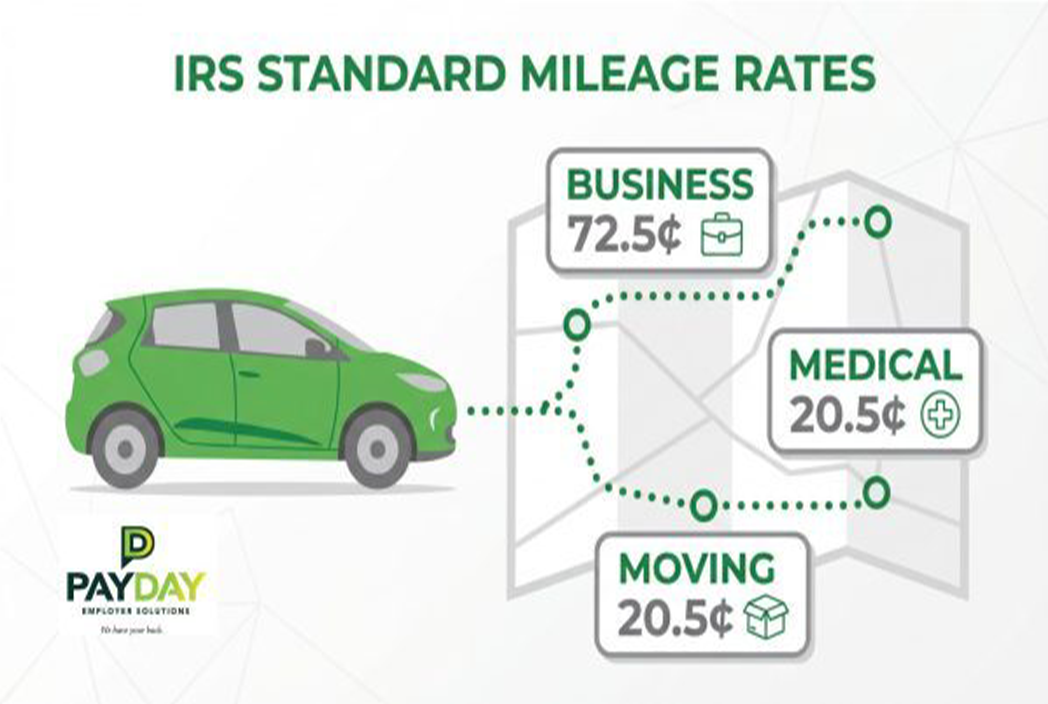

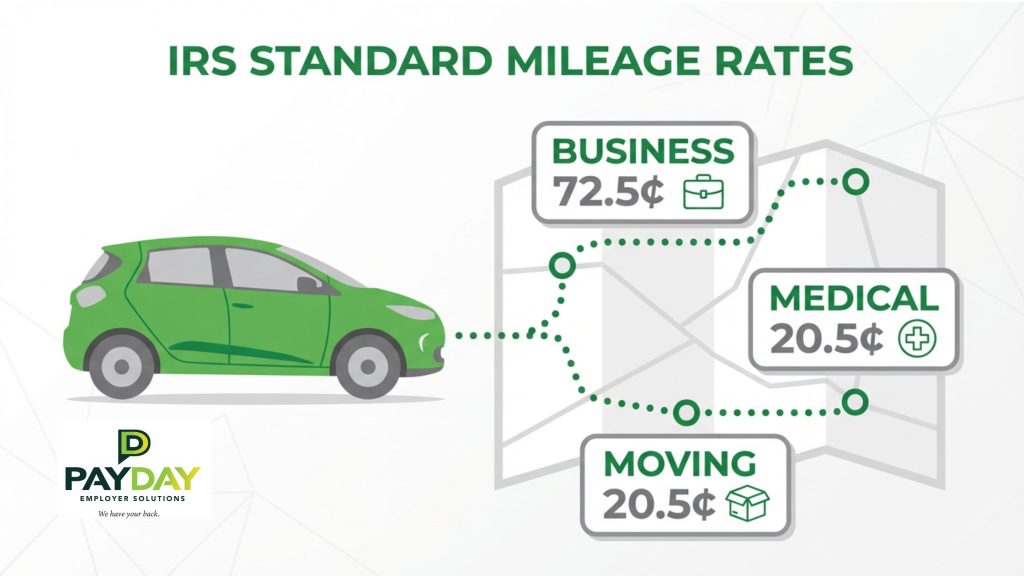

2026 Tax Facts: Updated IRS Mileage Rates

The IRS has updated its standard mileage rates for 2026, and these numbers directly impact how you reimburse employees and calculate deductions.

Business Travel

- 72.5 cents per mile

Medical Travel

- 20.5 cents per mile

Moving (Active-Duty Military Only)

- 20.5 cents per mile

What Employers Need to Know

Business mileage applies when employees use their personal vehicles for work-related travel. This includes client visits, off-site meetings, supply runs, and similar activities. This is typically the rate you’ll use most frequently.

Medical mileage covers travel to and from medical appointments, treatments, or facilities. This rate is significantly lower because it only accounts for the cost of operating the vehicle, not depreciation.

Only active-duty military members who relocate due to military orders can claim moving mileage. For most civilian employees, moving expense reimbursements are no longer tax-deductible.

Your Action Item

Review and update your company’s mileage reimbursement policy now. If you’re still using 2025 rates, your employees are either being shortchanged or you’re overpaying. Neither situation is ideal.

2026 Tax Facts: Federal Rates and Limits

These are the foundational figures that affect virtually every payroll calculation you make. Get them wrong, and the ripple effects touch everything from employee paychecks to your quarterly tax filings.

FICA and Social Security Updates

Social Security (OASDI) Wage Base

- $184,500

Social Security Withholding Rate

- 6.2%

Maximum Employer Social Security Withholding

- $24,480

Medicare (HI) Wage Base

- No limit

Medicare Withholding Rate

- 1.45%

Additional Medicare Tax (earnings over $200,000)

- 0.9%

What this means in plain English: Employees will pay Social Security taxes on the first $184,500 they earn in 2026. Once their wages exceed that threshold, Social Security withholding stops for the year. However, Medicare taxes continue on every dollar earned.

For your highest-paid employees, this also triggers the Additional Medicare Tax of 0.9% on earnings above $200,000. This additional tax is the employee’s responsibility. There’s no employer match.

Retirement Contribution Limits

Retirement benefits remain one of the most powerful tools for attracting and retaining talent. Here’s what employees can contribute in 2026:

Maximum Elective Deferral to 401(k)

- $24,500

Maximum Elective Deferral to SIMPLE 401(k)

- $17,000

Maximum Annual Contribution to Defined Contribution Plans

- Lesser of 100% of compensation or $72,000

Maximum Annual Compensation Taken into Account

- $360,000

Threshold for Definition of Key Employee and Top-Heavy Plans

- $235,000

Catch-Up Contributions (Age 50+)

Employees aged 50 and older can make additional catch-up contributions to supercharge their retirement savings:

401(k) Catch-Up Contribution

- $8,000

SIMPLE IRA Catch-Up Contribution

- $4,000

Why this matters: When combined with the standard 401(k) limit, employees over 50 can defer up to $32,500 in 2026. That’s a substantial tax-advantaged savings opportunity and a compelling reason for experienced workers to stay with employers who offer robust retirement plans.

Federal Employer Checklist

- Update payroll systems with the new $184,500 Social Security wage base

- Verify 401(k) and retirement plan contribution limits are correctly configured

- Communicate retirement limit increases to employees during open enrollment

- Review highly compensated employee classifications against new thresholds

- Confirm catch-up contribution eligibility is properly tracked for employees 50+

State-by-State Tax Highlights: NJ, NY, and PA

If you operate in the tri-state area, you already know that each state plays by its own rules. What’s compliant in Pennsylvania might trigger violations in New Jersey. What’s standard in New York City might not apply 50 miles north. Now for the state-specific 2026 tax facts that affect employers in the tri-state area.

Here’s your state-by-state breakdown for 2026.

New Jersey 2026 Tax Facts

State Hourly Minimum Wage

- $15.92

Minimum Cash Wage for Tipped Employees

- $6.05

State Unemployment Taxable Wage Base Limit

- $44,800

State Unemployment New Employer Rate

- 0.3825% to 5.6825%

Key Insights for NJ Employers:

New Jersey continues its trajectory of minimum wage increases, now reaching $15.92 per hour. This applies to most employees, with limited exceptions for seasonal workers and certain small businesses.

The unemployment taxable wage base of $44,800 is notably higher than neighboring states. This means New Jersey employers pay unemployment taxes on a larger portion of each employee’s wages. Plan your budget accordingly.

For businesses employing tipped workers, remember that the cash wage of $6.05 must be supplemented by tips to reach the full minimum wage. If tips fall short, you’re responsible for making up the difference.

New York 2026 Tax Facts

Minimum Wage (NYC, Nassau, Suffolk, and Westchester)

- $17.00 per hour

Minimum Wage (Remainder of State)

- $16.00 per hour

State Unemployment Taxable Wage Base Limit

- $17,600

State Unemployment New Employer Rate

- 4.025%

Key Insights for NY Employers:

New York’s tiered minimum wage system continues in 2026. Employees in New York City, Nassau County, Suffolk County, and Westchester County must receive at least $17.00 per hour. Everywhere else in the state, the minimum is $16.00 per hour.

If you have employees who work across county lines or who split time between locations, you’ll need to track hours carefully and apply the correct rate for each jurisdiction.

The unemployment taxable wage base remains relatively low at $17,600, but the new employer rate of 4.025% can add up quickly for growing businesses.

Pennsylvania 2026 Tax Facts

State Hourly Minimum Wage

- $7.25

Minimum Cash Wage for Tipped Employees

- $2.83

State Unemployment Taxable Wage Base Limit

- $10,000

State Unemployment Rate Range for Employers

- 1.419% to 14.4684%

Key Insights for PA Employers:

Pennsylvania’s minimum wage remains at the federal floor of $7.25 per hour. This is significantly lower than its neighbors. However, don’t let that fool you into complacency. Many Pennsylvania municipalities have enacted their own minimum wage ordinances, and competitive labor markets often require wages well above the legal minimum to attract qualified candidates.

The unemployment rate range of 1.419% to 14.4684% is one of the widest in the region. Your position within that range depends on your claims history. This is another reason to prioritize retention.

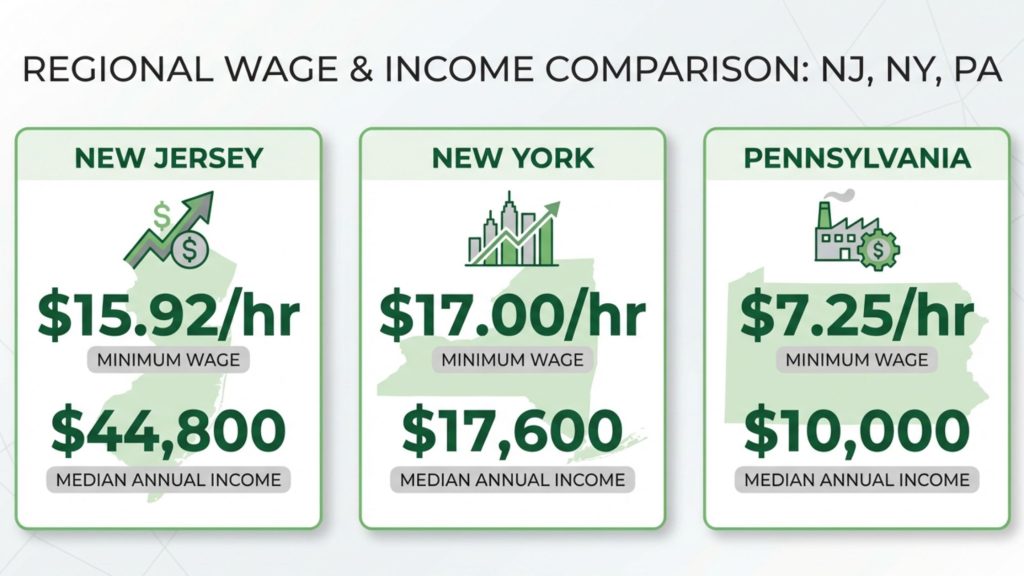

State Comparison at a Glance

Minimum Wage Comparison

- New Jersey: $15.92

- New York (NYC area): $17.00

- Pennsylvania: $7.25

Unemployment Wage Base Comparison

- New Jersey: $44,800

- New York: $17,600

- Pennsylvania: $10,000

New Employer Unemployment Rate Comparison

- New Jersey: 0.3825% to 5.6825%

- New York: 4.025%

- Pennsylvania: 1.419% to 14.4684%

The takeaway? Multi-state compliance is complex. If you’re managing payroll across state lines, the margin for error shrinks dramatically and the consequences of mistakes multiply.

How PayDay Employer Solutions Makes Tax Compliance Effortless

We get it. You didn’t start your business to become a tax expert. You started it to pursue your passion, serve your customers, and build something meaningful.

That’s where PayDay Employer Solutions comes in.

Our comprehensive payroll and HR solutions are designed to take the complexity of tax compliance off your plate so you can focus on what you do best.

Automated Tax Calculations

The platform automatically applies the correct federal, state, and local tax rates. When wage bases change or rates update, our platform adjusts accordingly. No manual intervention required. Automation reduces payroll processing time by up to 80% while virtually eliminating calculation errors.

Multi-State Payroll Support

Operating in New Jersey, New York, and Pennsylvania? No problem. For multi-state employers, we track each state’s unique requirements and applies the correct withholding rates, unemployment calculations, and minimum wage rules automatically.

Real-Time Compliance Updates

Tax laws change. Rates adjust. New requirements emerge. PayDay’s systems stay current so you don’t have to spend hours researching updates or worry about missing critical deadlines.

AI-Driven Error Detection

Additionally, intelligent systems flag potential issues before they become problems. From duplicate entries to suspicious calculations, we catch errors early. This saves you from costly corrections and potential penalties.

Employee Self-Service

Give your employees the tools to access their pay stubs, update their W-4 information, and manage their benefits. All without burdening your HR team. It’s a win-win for efficiency and employee satisfaction.

2026 Tax Facts: Frequently Asked Questions

Here are answers to common questions about these 2026 tax facts and how they impact your business.

Q: When do these 2026 tax changes take effect?

Federal changes took effect January 1, 2026. These include the new Social Security wage base and retirement contribution limits. State minimum wage changes typically take effect on January 1 as well, though some states implement changes on different dates. Always verify effective dates for your specific jurisdictions.

Q: How do I update my payroll system for the new Social Security wage base?

If you’re using PayDay’s payroll services, you don’t have to do anything. Our automated systems handle these updates automatically. If you’re managing payroll manually or using other software, you’ll need to update the wage base setting before processing your first 2026 payroll.

Q: What happens if I have employees in multiple states?

Multi-state compliance requires tracking each employee’s work location and applying the correct state and local taxes. This includes income tax withholding, unemployment insurance, and minimum wage requirements. PayDay’s multi-state payroll solutions automate this process, ensuring each employee is taxed correctly based on where they work.

Q: Are catch-up contributions mandatory to offer?

No, catch-up contributions are not mandatory. However, offering them is a valuable recruitment and retention tool for experienced employees who are actively planning for retirement. If your 401(k) plan doesn’t currently allow catch-up contributions, consider updating your plan documents to include this option.

Q: What if my state isn’t listed here?

This guide focuses on New Jersey, New York, and Pennsylvania, the primary states served by PayDay Employer Solutions. If you operate in additional states, contact our team for customized guidance on your specific compliance requirements.

Download Your 2026 Tax Facts

Want these numbers at your fingertips all year long? Download our printable 2026 Tax Facts PDF. It’s perfect for posting in your break room, sharing with your accounting team, or keeping in your files for quick reference.

Stay Compliant. Stay Confident. We Have Your Back.

Tax compliance doesn’t have to be overwhelming. With the right partner and the right tools, you can navigate even the most complex regulatory landscape with confidence.

PayDay Employer Solutions has been helping businesses like yours manage payroll, benefits, and compliance for years. Our team understands the unique challenges of operating in the tri-state area, and we’re here to help you succeed. Ready to Simplify Your Payroll? Contact us today!