Hiring without background checks is like navigating a dark room and hoping you don’t stumble. You might avoid the obstacles, but is that a risk worth taking?

The hiring process is more than interviews and intuition—it’s about getting the facts to make informed decisions. In this guide, we’ll explore the essential role of background checks, how to implement them without headaches, and how they protect your company from costly mistakes and reputational risks.

Why Background Checks Matter

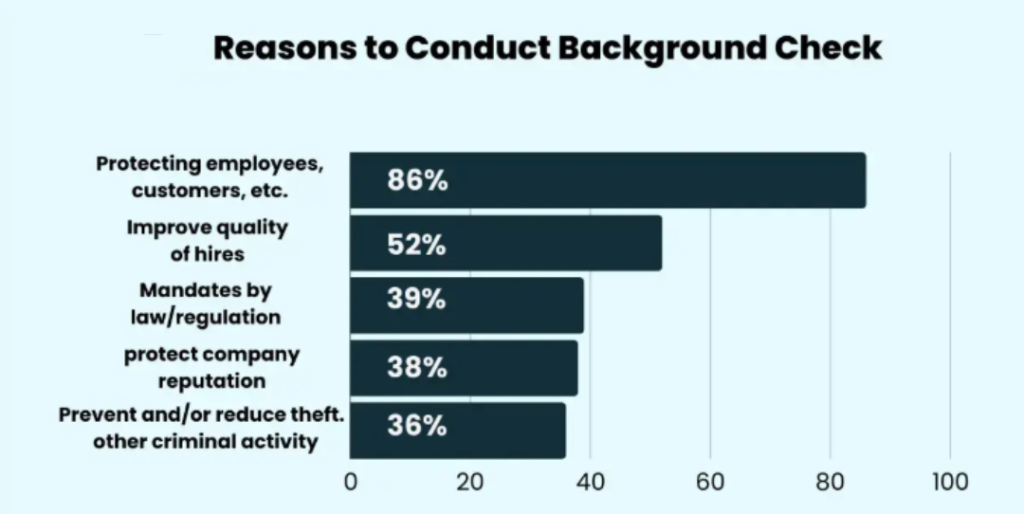

1. Building Trust and Reducing Risks

Hiring is always a calculated risk. Skipping proper vetting could mean entrusting your company’s future to someone who isn’t up to the task. With many candidates admitting to embellishing resumes, even small exaggerations can lead to significant consequences. Properly verifying employment history and criminal records is essential to building trust and reducing workplace risks.

Example: Hiring a “certified accountant” without proper checks could lead to severe financial repercussions if their credentials turn out to be fabricated.

2. Safeguarding Workplace Safety

Creating a safe workplace extends beyond physical safeguards—it includes fostering emotional and ethical security. Background checks don’t just spot potential dangers; they actively protect your team from harm.

Think of background checks as preventative medicine for your culture: They reveal issues before they escalate into a full-blown crisis.

3. Enhancing Brand Reputation

Employees represent your brand. A poor hire, whether unprincipled or underqualified, can damage customer relationships and business credibility.

A company’s reputation is like its credit score—hard-earned but easily destroyed. Background checks ensure every hire contributes positively to that reputation.

How to Implement Background Checks in the Hiring Process

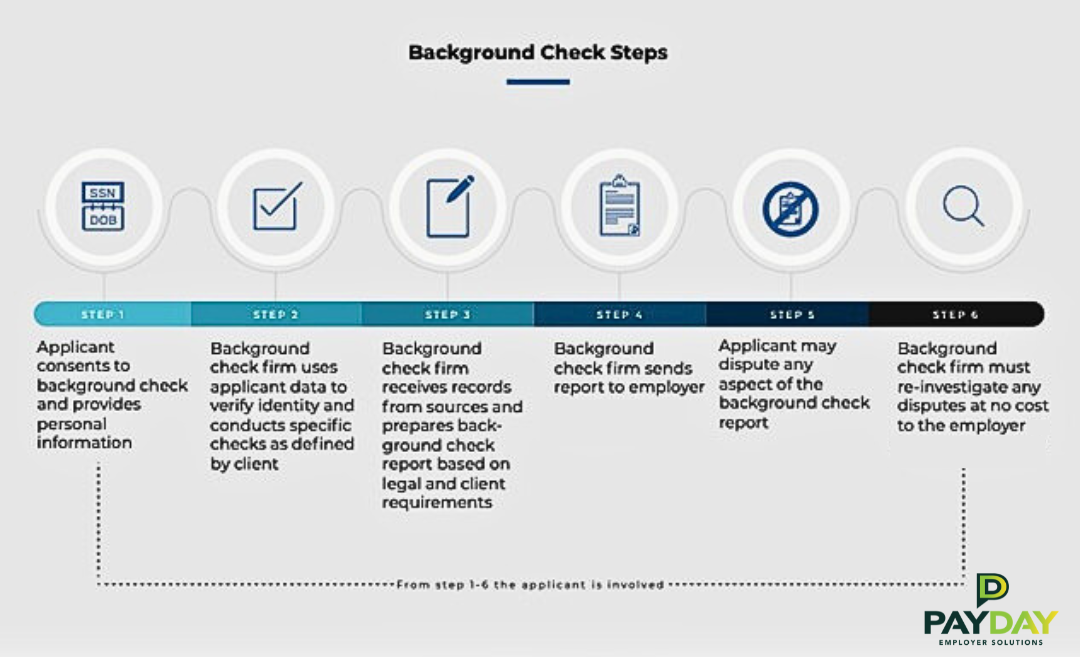

DIY background checks are a minefield of compliance risks. Partnering with experienced providers ensures accuracy, privacy, and adherence to regulations such as GDPR or FCRA. Tailoring checks to specific job roles while maintaining compliance with legal frameworks is critical to a successful hiring process.

1. Identify Role-Specific Screening Needs

Each role comes with unique risks and requirements. Customizing background checks ensures candidates meet specific job demands and organizational expectations. Customized hiring methods, as outlined in Supercharge Your Talent Acquisition, demonstrate how role-specific strategies can significantly boost recruitment outcomes.

Examples:

- Financial roles → Credit history and criminal records.

- Customer-facing roles → Character references and soft skills validation.

- Drivers → DMV records and substance testing.

Think of this as a risk-reward analysis. The greater the stakes, the deeper your vetting process should go.

2. Be Transparent and Obtain Consent

Transparency during the hiring process establishes trust and encourages open communication with candidates. Include a detailed background check policy in your job descriptions, and explain the process to candidates early on.

Best Practice:

Send candidates a brief overview of what the check includes and why it’s necessary. This not only keeps you compliant but ensures candidates feel respected.

3. Partner with Trusted Screening Providers

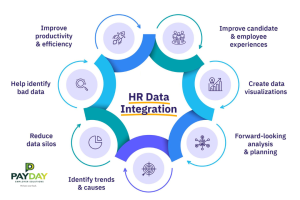

When efficiency and compliance align, background checks seamlessly integrate into broader HR and payroll systems. This streamlined approach reflects the transformative potential of business automation, as highlighted in HR Integration and Payroll Systems.

Checklist for Choosing Providers:

- Verified compliance with industry regulations.

- Customizable packages tailored to your needs.

- Strong reviews and client recommendations.

Key Areas to Focus During Employee Screening

Background checks can feel overwhelming, but honing in on three primary areas ensures your process is thorough and targeted.

1. Qualifications and Experience

Verify educational credentials, professional certifications, and employment history to avoid costly mistakes. A detailed review confirms whether the candidate possesses the skills and experience they profess..

PayDay Tip:

“Don’t stop at verifying degrees or job titles—cross-check dates of employment and ask for details about their role. This can uncover inconsistencies that traditional resume reviews miss. Services like LinkedIn Recruiter or education verification tools can help streamline the process.”

2. Cultural Fit and Character

A candidate’s principles should align with your company culture to encourage harmony and cohesion. Use behavioral assessments and reference checks to gauge compatibility.

PayDay Tip:

“When checking references, ask open-ended questions like, ‘Can you describe how they responded to team conflicts?’ This reveals more than yes-or-no queries.”

3. Criminal Records

While criminal history doesn’t automatically disqualify a candidate, relevance is key. Focus on offenses that directly relate to the role’s responsibilities. For example, a recent fraud conviction may disqualify someone from a financial role, while a decades-old non-violent offense might not be as concerning.

PayDay Tip:

“Use state-compliant tools like those offered by government or third-party platforms to avoid bias and ensure fairness in criminal record reviews. Always communicate to candidates how findings will be assessed and give them a chance to clarify any discrepancies.”

Advantages and Challenges of Background Checks

Advantages:

- Hiring Confidence: Verified candidates empower you to make informed hiring decisions.

- Workplace Safety: Comprehensive checks help identify potential risks, promoting a positive work environment.

- Legal Protection: Adhering to screening protocols minimizes liability and ensures compliance.

Challenges and Solutions:

- Cost → Use services with No Account Setup Fees or Monthly Minimums.

- Cost Concerns → Adopt tiered screening—basic checks for most roles and in-depth checks for high-stakes positions.

- Potential Bias → Work with providers trained in Equal Employment Opportunity compliance to ensure fair practices.

Best Practices for Background Checks in Hiring

To make your checks efficient and fair, follow these golden rules:

- Know the Law: Research local, state, and federal regulations. Lack of awareness can result in legal challenges and unnecessary expenses.

- Be Role-Specific: Over-screening wastes time and money. Focus only on what’s relevant to the job.

- Apply Consistent Criteria: Ensure fairness by using uniform standards for all candidates applying to the same role.

Your Next Steps for Safer Hiring Practices

Background checks are more than just a safety measure—they’re your secret weapon for building a smarter, safer, and more cohesive workplace. By verifying credentials, assessing character, and maintaining compliance, you protect your team and elevate your business reputation.

Take Action Today!

Ensure your hiring process is as robust as it is seamless. Partner with Payday Employer Solutions to implement effective background checks and employee screening systems tailored to your business needs. Let’s build safer, smarter workplaces together!

FAQs

What are the most important elements of a background check?

- Focus on qualifications, criminal history, and cultural fit to ensure a thorough vetting process.

How can companies manage delays in background checks?

- Use tech-enabled platforms to automate and expedite the process.

Are background checks legally required?

- They depend on the role and jurisdiction. Research local labor laws for guidance.

How should discrepancies in reports be handled?

- Evaluate the severity of the issue and discuss it transparently with the candidate.

Can background checks prevent workplace misconduct?

- While not foolproof, they significantly reduce risks by identifying potential red flags.

What industries benefit most from background checks?

- Sectors like finance, healthcare, education, and transportation require stringent checks due to higher risks.