PayDay 2026 Tax Facts: Your Complete Guide to Navigating This Year’s Tax Changes

New Year, New Numbers: Is Your Payroll Ready for 2026? The calendar just flipped, and our 2026 Tax Facts guide is here to help. With a new year comes significant changes to federal wage bases, retirement limits, and state requirements. Therefore, if you haven’t adjusted your payroll systems yet, now is the time to act. […]

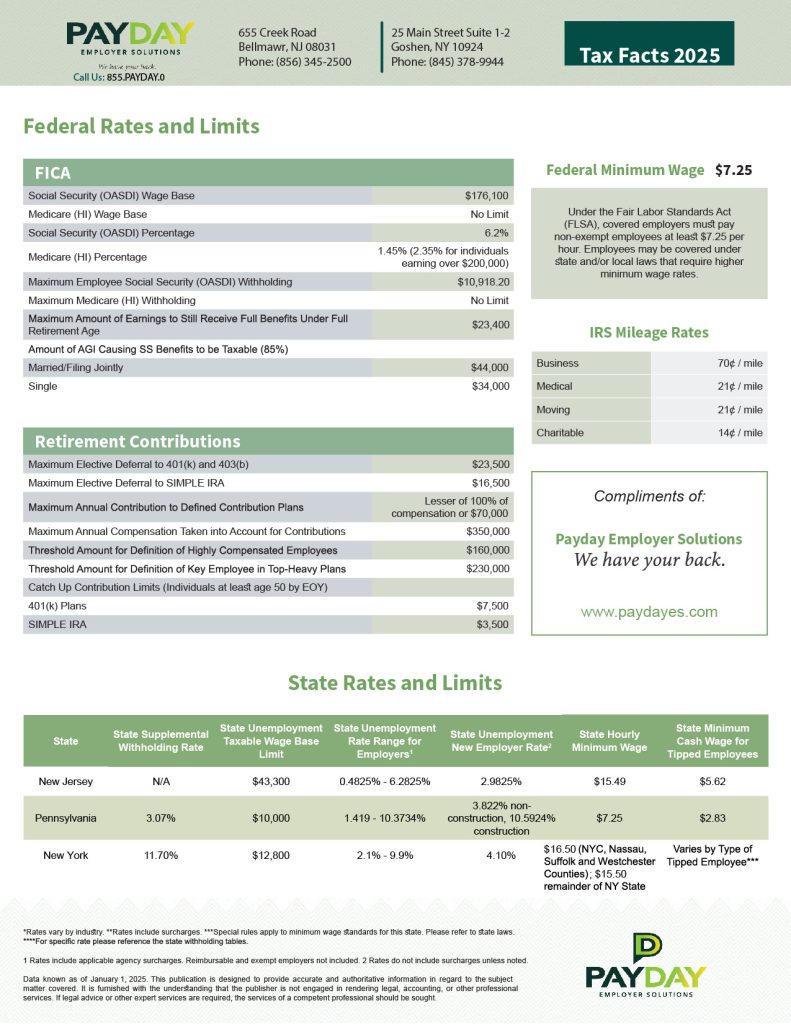

PayDay Employer Solutions 2025 TAX FACTS – Navigating Tax Changes in 2025 with Ease

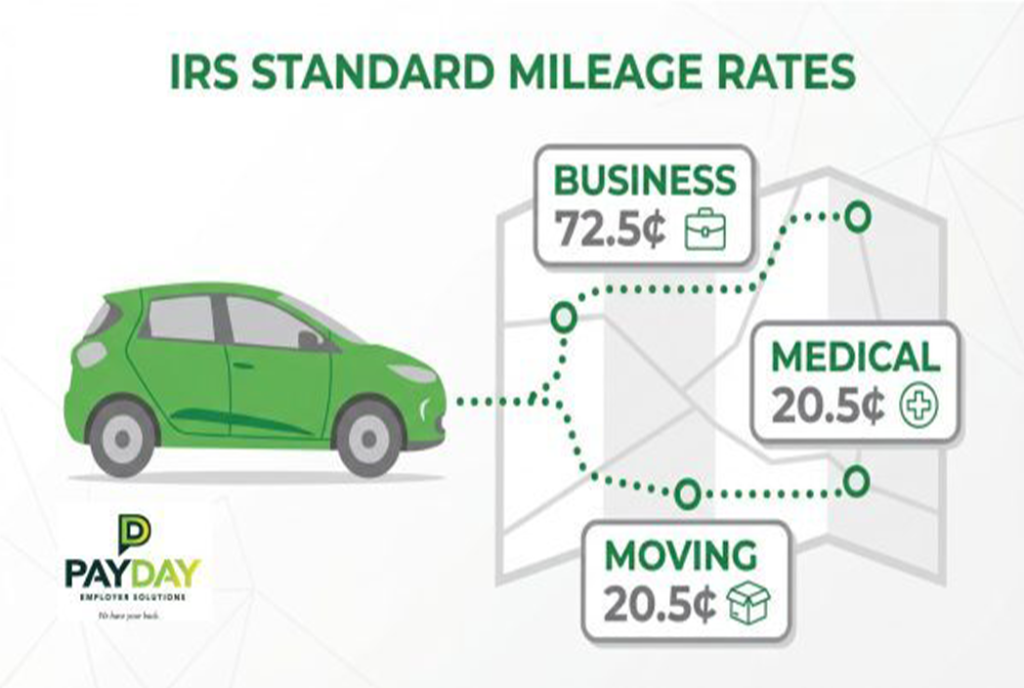

As businesses gear up for the new year, staying on top of tax updates is crucial for compliance and financial planning. The Payday 2025 Tax Facts highlight key federal and state-level changes that every business owner and HR professional should know. Key Federal 2025 Tax Facts Updates: State Tax 2025 Tax Facts Highlights: Tax rates […]

Maximizing Efficiency with Comprehensive Payroll Services

Comprehensive payroll services are crucial for any business, impacting everything from employee satisfaction to compliance with tax regulations. Outsourcing payroll can save time, reduce errors, and ensure compliance. PayDay Employer Solutions offers comprehensive payroll services designed to streamline business operations and boost efficiency. Benefits of Outsourcing Payroll Services: How PayDay’s Payroll Services Stand Out: What […]

Compliance Tax Deadlines July 2024: Key Dates and Requirements

Staying Compliant with Tax and HR Deadlines Staying compliant with tax and HR deadlines is crucial for any business. Therefore, here are the important compliance tax deadlines for July 2024. Important Compliance Tax Deadlines for July 2024 Employee Tip ReportingDeadline: July 10, 2024 Ensure employees report tips over $20 earned in June of 2024 by […]

WHAT IS AN “EFTPS” ACCOUNT AND WHY SHOULD EVERY EMPLOYER HAVE ONE?

This free account can help business owners keep track of and ensure all tax payments are made timely. The Electronic Federal Tax Payment System (EFTPS) is the free, easy to use account offered to employers and third-party providers to make mandatory electronic federal…