The Silent Heist: How to Spot and Stop Payroll Bank Account Fraud Before It Hits

Payroll Bank Account Fraud is creeping into businesses like a wolf in a suit, slick, silent, and ready to pounce. And if you’re still relying on outdated systems or trusting an email with a smiley face at the end, you’re setting yourself up to get bitten. Let’s break down exactly what’s going on and how […]

Mastering Form W-2 Box 1: The Ultimate Breakdown for Employers

Form W-2 Box 1 might seem like just another field on a tax form, but don’t underestimate its significance. It’s the foundation of income tax reporting, summarizing an employee’s taxable wages. The IRS scrutinizes this field closely, and inaccuracies can lead to penalties, tax audits, and frustrated employees. For employers, getting Box 1 right is […]

Plan Ahead with the 2025 PayDay ES Payroll Calendar

Staying on top of your payroll schedule is essential for running a smooth operation. The 2025 PayDay ES Payroll Calendar is your go-to resource for staying on track with payroll deadlines, federal holidays, and bank closures. With this essential tool in hand, you’ll ensure seamless payroll operations throughout the year. Why Use the 2025 PayDay […]

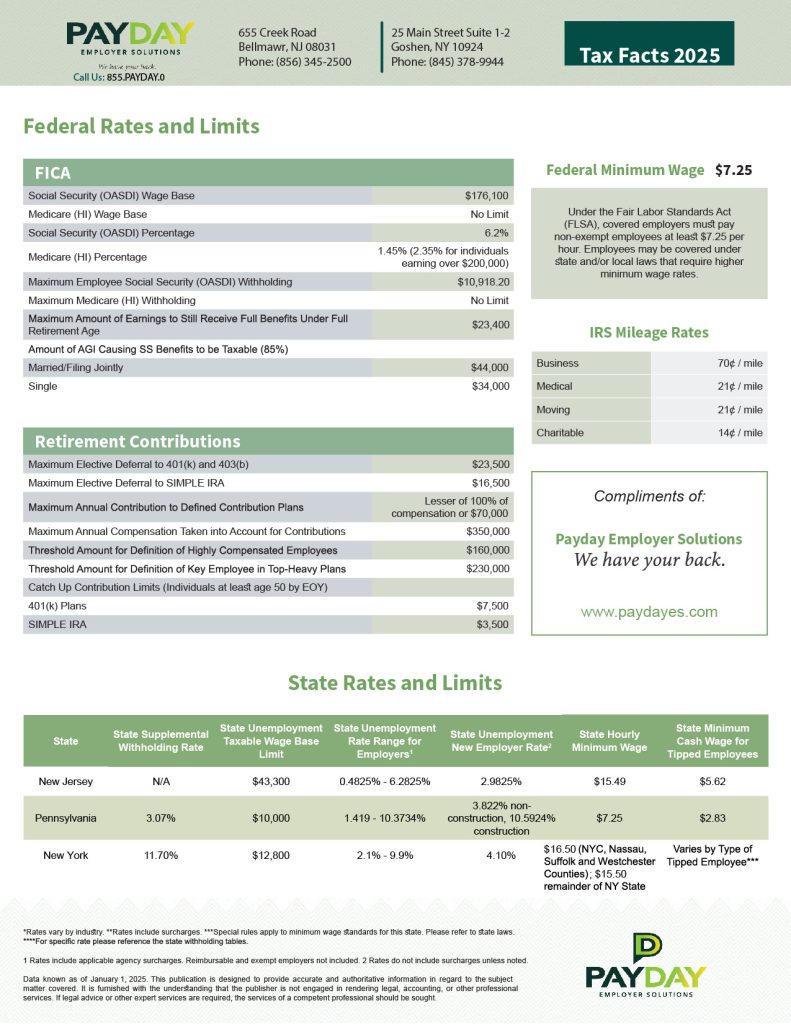

PayDay Employer Solutions 2025 TAX FACTS – Navigating Tax Changes in 2025 with Ease

As businesses gear up for the new year, staying on top of tax updates is crucial for compliance and financial planning. The Payday 2025 Tax Facts highlight key federal and state-level changes that every business owner and HR professional should know. Key Federal 2025 Tax Facts Updates: State Tax 2025 Tax Facts Highlights: Tax rates […]