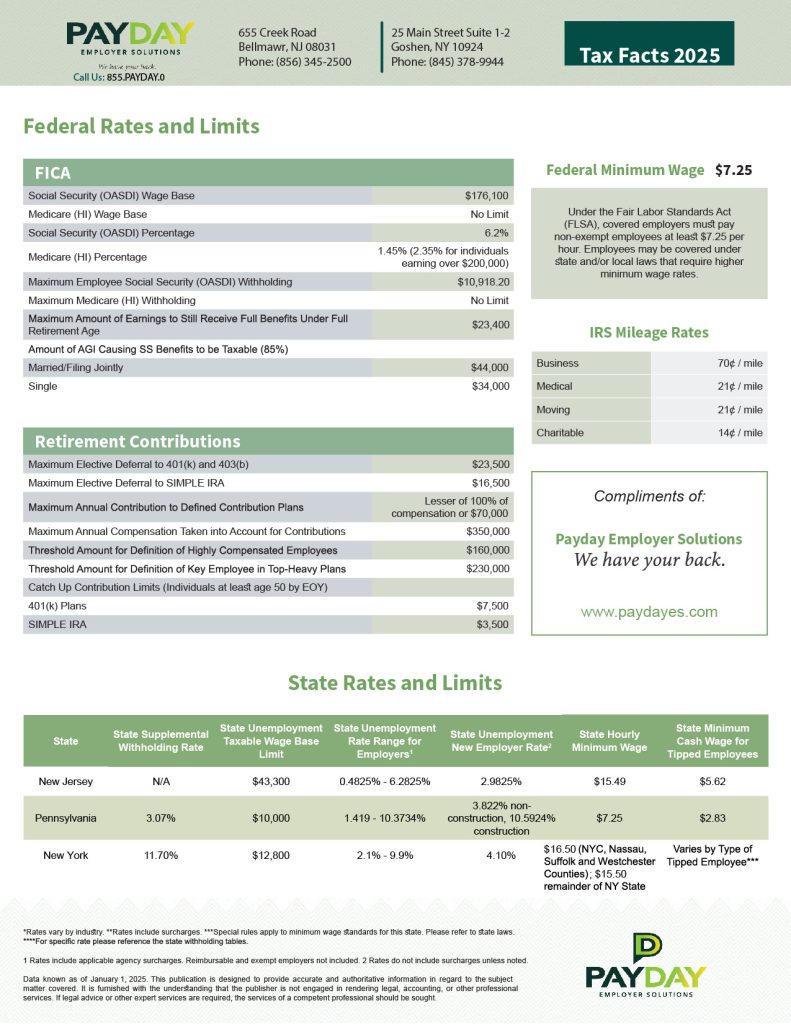

PayDay Employer Solutions 2025 TAX FACTS – Navigating Tax Changes in 2025 with Ease

As businesses gear up for the new year, staying on top of tax updates is crucial for compliance and financial planning. The Payday 2025 Tax Facts highlight key federal and state-level changes that every business owner and HR professional should know. Key Federal 2025 Tax Facts Updates: State Tax 2025 Tax Facts Highlights: Tax rates […]