Staying Compliant with Tax and HR Deadlines

Staying compliant with tax and HR deadlines is crucial for any business. Therefore, here are the important compliance tax deadlines for July 2024.

Important Compliance Tax Deadlines for July 2024

Employee Tip Reporting

Deadline: July 10, 2024

Ensure employees report tips over $20 earned in June of 2024 by this date. Additionally, for more information on tip reporting, please check the IRS guidelines.

Payroll Tax Deposits for Monthly Depositors

Deadline: July 15, 2024

Monthly depositors must submit their June payroll tax deposits by this date. Consequently, stay compliant to avoid penalties. For more details, refer to our 2024 Payroll Calendar.

Second Quarterly Contribution for Defined Benefit Pension Plans

Deadline: July 15, 2024

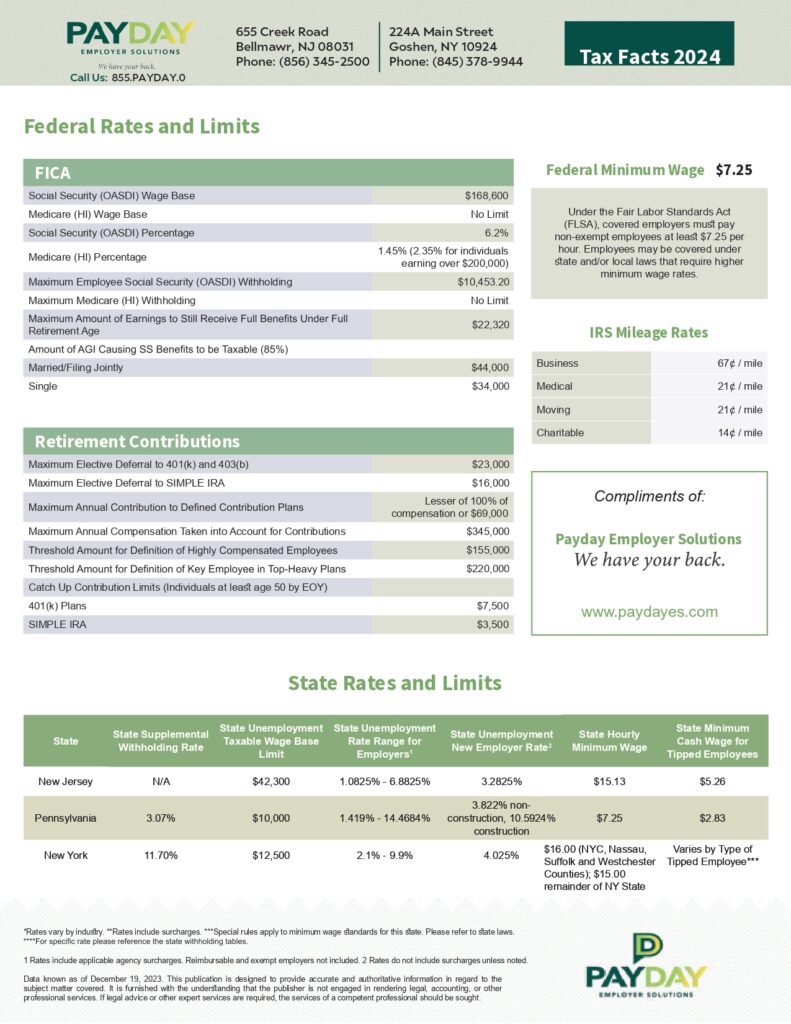

Ensure the second quarterly payment is made to meet minimum funding requirements for defined benefit pension plans. Moreover, you can learn more about these contributions in our 2024 Tax Facts guide.

Form 941 Filing

Deadline for Q2: July 31, 2024

File Form 941 for Q2 by this date to report income, Social Security, and Medicare taxes withheld from employees’ paychecks. Additionally, for instructions, visit the IRS website.

Form 720 Filing

Deadline for Q2: July 31, 2024

Businesses liable for excise taxes must file Form 720 for Q2 by this date. Furthermore, check the IRS website for more details.

FUTA Second Quarter Tax Payment Due

Deadline: July 31, 2024

If your FUTA tax liability exceeds $500 through June, make your second quarterly payment by this date using EFTPS. In addition to and for more on electronic payments, read our article on EFTPS account benefits.

Form 730 Filing Deadline for June Wagers

Deadline: July 31, 2024

File Form 730 if you accepted wagers in June. Additionally, learn more about wagering tax requirements on the IRS website.

Form 2290 Filing Deadline for Vehicles First Used in June

Deadline: July 31, 2024

File Form 2290 for heavy highway vehicles first used in June 2024 by this date. Moreover, more information can be found in our 2024 Tax Facts guide.

State Unemployment Insurance Taxes Due

Deadline: July 31, 2024

State unemployment tax returns for Q2 are due. Therefore, check your state’s specific requirements to stay compliant.

State Income Tax Withholding Quarterly Returns Due

Deadline: July 31, 2024

For states with income tax, Q2 returns are due by this date. Ensure timely submission to avoid penalties. Moreover, more details are available in our 2024 Tax Facts guide.

Local Payroll Taxes Due

Deadline: July 31, 2024

Businesses in states with local payroll taxes need to file Q2 returns by this date. Consequently, stay updated with your local regulations through our 2024 Payroll Calendar.

You may owe local taxes and have to file quarterly tax returns this month if you have employees working in the following states:

HR Compliance Tax Deadlines for July 2024

- Summary of Material Modification (SMM) – July 29, 2024: Distribute SMM for retirement plan changes made in 2023. Additionally, for guidance, check out our article on navigating retirement plans.

- Form 5330 Filing Deadline – July 31, 2024: Report excise taxes related to employee benefit plans.

- Forms 5500 and 5558 Filing Deadline – July 31, 2024: File annual return for employee benefit plans or request an extension.

- Annual Benefit Statements for Individual Account Plans – July 31, 2024: Provide benefit statements to employees.

Final Thoughts and Next Steps

Meeting these deadlines is essential for compliance and smooth business operations. Therefore, for more information on managing your payroll and HR obligations, Contact Us today at PayDay Employer Solutions. Furthermore, stay informed and prepared with resources like our IRS Tax Withholding Estimator and insights on building a winning workforce.