Picture this: a bustling marketplace where every customer expects instant service, speed, and security. That’s the digital economy today—fast, relentless, and ever-demanding. In this high-speed world, businesses that rely on clunky, outdated payment methods risk getting left in the dust. Enter credit card payment solutions—the unsung heroes of modern commerce, now brought to you by Payday Employer Solutions. With our new credit card processing services, we’re not just keeping up—we’re setting the pace.

In this article, we’ll unpack how these smart solutions are reshaping the way merchants operate and why solutions like Payroc by Payday Employer Solutions might just be the upgrade your business needs.

What Is Credit Card Processing?

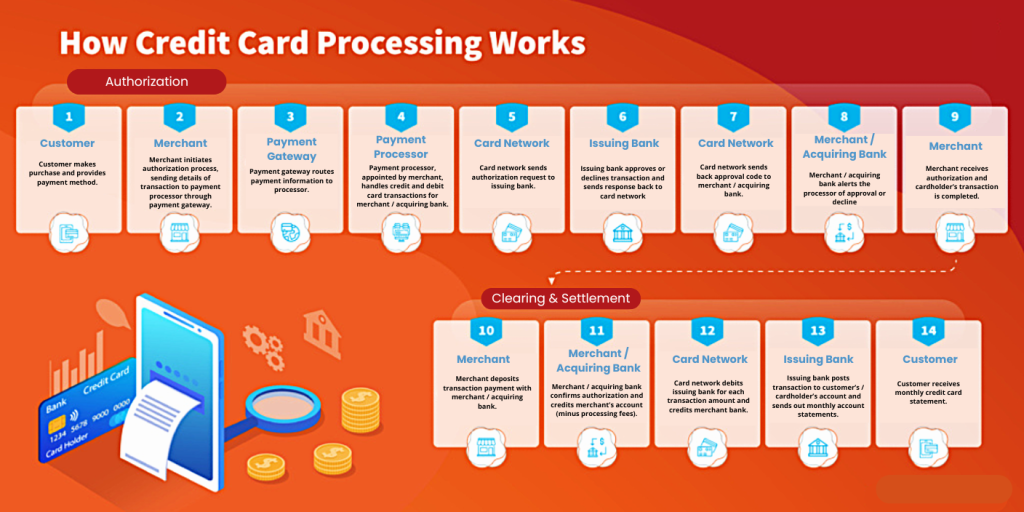

Think of credit card processing as the invisible bridge connecting your customer’s wallet to your business’s cash register. With Payday’s new credit card processing service, this seamless process is now more accessible, reliable, and cost-effective for businesses of all sizes. With a quick swipe, tap, or chip insert, a complex dance begins behind the scenes. This digital ballet involves several key players working together to ensure one thing—money moves securely from point A to point B, and fast. Here’s how it works in four simple steps:

- The customer presents their card.

- The merchant’s system kicks into action, sending a request to the payment processor.

- The issuing bank plays gatekeeper, verifying and approving (or declining) the transaction.

- If all goes well, funds are settled, and the merchant gets paid.

No drama, no delays—just instant access to funds in a world where time is money.

Key Players in Credit Card Processing

Every smooth transaction has its stars behind the curtain. In the world of credit card processing, these unsung heroes are:

- Issuing Bank: The one who hands out the credit card to your customer.

- Acquiring Bank: The bank that ensures you, the merchant, get paid.

- Payment Processor: The glue holding it all together, managing the flow of data and ensuring security every step of the way.

And the best part? This entire process—request, approval, settlement—happens faster than you can say “Approved.” Payday steps in as your trusted partner, ensuring not just smooth transactions but also tailored solutions for your unique business needs. It’s a financial symphony, playing in perfect harmony.

What Are Merchant Services?

If credit card processing is the engine, merchant services are the dashboard, steering wheel, and fuel that power your business forward. They’re not just about accepting payments—they’re about elevating the entire buying experience. From sleek payment terminals to smart POS systems that track inventory and customer data, modern merchant services are the ultimate toolkit for businesses wanting to thrive in a cashless world.

Key components include:

- Payment Terminals: The physical devices for accepting in-store payments.

- Payment Gateways: Your digital checkout counter for online sales.

- POS Systems: The nerve center that tracks sales, inventory, and customer relationships in one place.

Businesses that lag behind in adopting these tools might as well be stuck in a queue with customers who have already walked out.

Why Credit Card Payment Solutions Matter for Businesses

Why should businesses care about credit card payment solutions? Because they’re the shortcut to speed, sales, and staying ahead in a hyper-competitive world. With Payday’s credit card processing solutions, your business benefits from industry-leading speed, security, and savings—all while providing your customers the convenience they expect. Here’s what they bring to the table:

For Businesses:

- Speed: Fast transactions mean happier customers and shorter queues.

- Higher Sales: Cards encourage bigger spenders—simple as that.

- Security: Built-in fraud prevention tools offer peace of mind.

- Borderless Business: Accept payments from around the globe with ease.

For Customers:

- Convenience: Whether in-store, online, or on mobile, they call the shots.

- Perks & Rewards: From cashback to loyalty points, using a card often comes with perks.

- Safety Net: With fraud protection and zero liability policies, customers feel safer swiping.

In short, it’s a win-win for everyone involved.

How Credit Card Payment Solutions Are Evolving

Just when you thought payments couldn’t get any faster, easier, or more secure, innovation steps up again. Payday’s innovative solutions, such as contactless payment options and mobile wallet integrations, ensure your business stays future-ready.Here’s how credit card payment solutions are evolving to meet tomorrow’s needs:

- Contactless Payments: Think tap-and-go, making checkouts lightning fast.

- Mobile Wallets: Apple Pay, Google Pay—your phone is now your wallet.

- Subscription Billing: Ideal for the Netflix generation, this feature is a game-changer for businesses with recurring revenue models.

These aren’t just trends—they’re the future of commerce.

Key Solutions Credit Card Payment Processing Offers

Every modern business needs a solid payment solution—one that doesn’t just process transactions but also protects your bottom line. Here’s what cutting-edge systems bring to the table:

- Fraud Prevention Tools: Keep the crooks out and your revenue in.

- Chargeback Management: Streamlined dispute resolution to minimize losses.

- Reporting & Analytics: Turn transaction data into actionable insights.

These aren’t just bells and whistles—they’re business essentials.

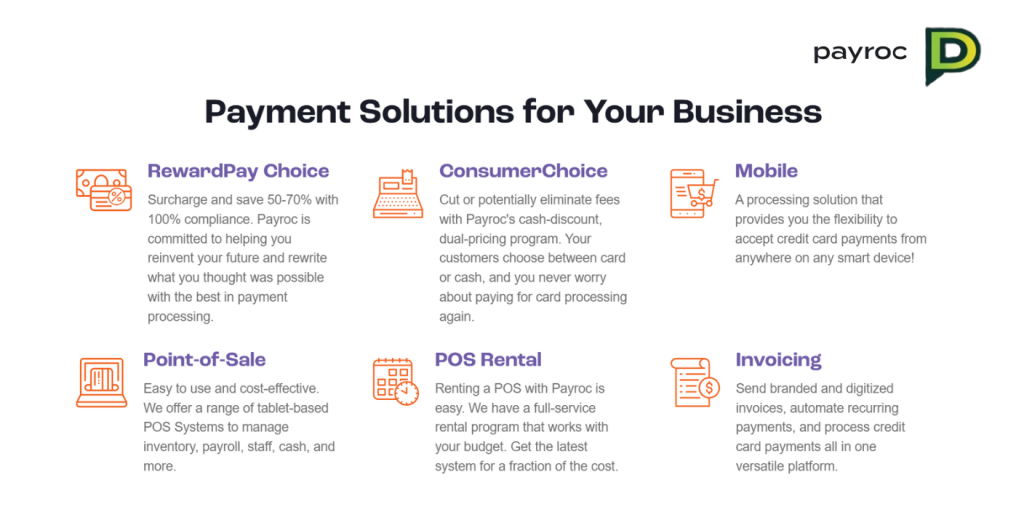

Why Payroc Is the Right Solution for Businesses

If you’re after a payment solution that’s secure, flexible, and future-proof, look no further than Payroc by Payday Employer Solutions. Here’s why:

- Ironclad Security: Advanced fraud protection gives you and your customers peace of mind.

- Flexibility: From credit cards to mobile wallets, Payroc handles it all.

- Seamless Integration: Whether you’re online, offline, or somewhere in between, Payroc fits right in.

Payday’s New Credit Card Processing Services

At Payday Employer Solutions, we understand that reliable payment processing is essential for every business. That’s why we’ve introduced our new credit card processing services. Here’s what sets us apart:

- Competitive Rates: Reduce processing fees without compromising on quality.

- Custom Solutions: Tailored to fit businesses of every size and sector.

- 24/7 Support: We’re here whenever you need assistance. Ready to explore the difference? Learn more about our credit card processing solutions here.

Transform Your Business with the Right Payment Solutions

The right payment solution isn’t just a tool—it’s a catalyst for growth. By adopting advanced platforms like Payroc, you’re not just processing payments; you’re improving the entire customer experience, speeding up cash flow, and safeguarding your business from risk. In a digital-first economy, you either adapt or get left behind.

Ready to transform your payment processing? Contact Tim Chew, our Payroc payment professional, to streamline your business and lower your overhead in minutes.

FAQs

How do credit card payment solutions enhance security?

Modern systems use encryption, tokenization, and fraud detection tools to protect sensitive customer data.

What are merchant services?

Merchant services include all technologies and systems that enable businesses to accept payments, both online and offline.

Why should businesses consider contactless payment solutions?

Contactless payments improve checkout speed and enhance customer convenience, reducing wait times.

Can small businesses benefit from Payroc’s solutions?

Absolutely! Payroc offers scalable solutions that cater to businesses of all sizes.

What is chargeback management?

Chargeback management helps businesses handle disputes efficiently, minimizing revenue loss.

Is Payroc suitable for e-commerce businesses?

Yes, Payroc provides secure online gateways and integrates seamlessly with popular e-commerce platforms.