For most people, December means lights, laughter, and a well-earned break.

For HR and payroll teams, it’s a race against the clock. Checklists, reconciliations, and compliance chaos.

The good news? With the right strategy, year-end can be your most powerful moment of control, a chance to close the books cleanly and set your team up for a stronger, more compliant 2026.

1. Year-End Compliance Wrap-Up: Every Detail Matters

As the calendar winds down, compliance takes center stage. Every figure, every form, every filing counts.

Here’s what to tackle first:

- Final Payroll Reconciliations: Match year-to-date totals across all systems and resolve discrepancies before January hits.

- W-2 and 1099 Preparation: Confirm employee names, Social Security numbers, and addresses early. Fewer corrections mean fewer headaches later.

- ACA Reporting: Employers with 50+ FTEs must file Forms 1094-C and 1095-C accurately and on time. The IRS won’t move the date for you.

- State and Local Tax Checks: Remote and hybrid work complicate tax obligations. Review each jurisdiction carefully.

A complete compliance closeout goes beyond avoiding fines. It shows that your organization values accuracy and integrity.

2. Benefits & 401(k) Planning: Wrap Up and Strengthen

December is the time to align benefits, savings, and strategy. A quick audit can reveal opportunities to save money, boost engagement, and reinforce your culture.

Key areas to review:

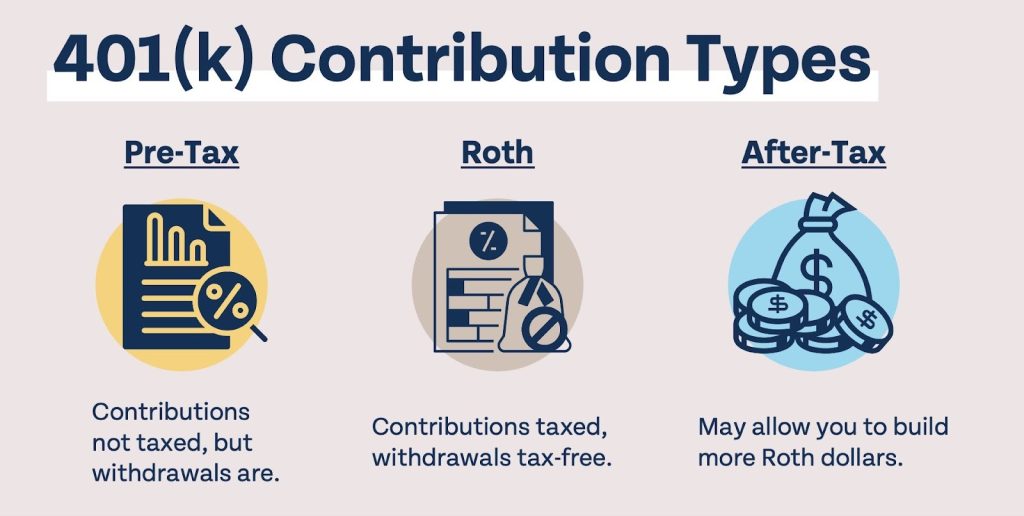

- 401(k) Contributions: 2025 limit: $23,500, with a $7,500 catch-up for employees 50+. Employer matches reduce tax liability and support retention.

- SECURE 2.0 Act Updates: Use student loan contribution matching and SMB tax credits for new plans.

- Benefits Data Review: Track enrollment, costs, and participation rates to confirm your offerings still meet employee needs.

- Communication: Employees who understand their benefits are twice as likely to stay. Clear communication is your secret weapon.

When compliance and care align, loyalty follows naturally.

3. Planning for 2026: Using Compliance as a Strategic Tool

Once the paperwork is filed, shift focus to what’s next. December is your moment to recalibrate and refocus for the year ahead.

Turn compliance data into momentum:

- Review Policies and Handbooks: Update PTO, pay transparency, and hybrid work policies to stay aligned with new laws.

- Upgrade Your Tech Stack: Automate onboarding and payroll to cut human error and free your HR team’s time.

- Develop Your People: Budget for leadership training, DEI programs, and skill development. The foundation of long-term resilience.

- Partner with a PEO: Simplify payroll, benefits, and compliance while keeping your focus on growth and culture.

Compliance shows where you’ve been. Strategy defines where you’re going. Together, they prepare your business for the future.

4. The Partner Advantage: Streamline and Strengthen

You can’t automate judgment. You can’t outsource accountability. But you can choose better partners.

A trusted HR and payroll provider helps you:

- Remove compliance guesswork.

- Simplify benefits administration.

- Gain informed guidance for people-first growth.

December doesn’t have to mean burnout, it can mean breakthrough. Finish the year with confidence, enter 2026 clear and compliant, and turn your HR systems into a real competitive edge.

Let’s Make Year-End Simple Together.

Our HR and payroll specialists are here to take the stress off your plate.

*******@******es.com?subject=Email%20from%20blog%20article&body=Name:%0D%0ACompany:%0D%0APhone:%0D%0A%0D%0AComments:” target=”_blank” rel=”noreferrer noopener”>Contact us now to finish strong, stay compliant, and step boldly into 2026.