Form W-2 Box 1 might seem like just another field on a tax form, but don’t underestimate its significance. It’s the foundation of income tax reporting, summarizing an employee’s taxable wages. The IRS scrutinizes this field closely, and inaccuracies can lead to penalties, tax audits, and frustrated employees. For employers, getting Box 1 right is a balancing act of compliance, precision, and transparency. This guide unpacks its intricacies so you can manage it confidently and efficiently.

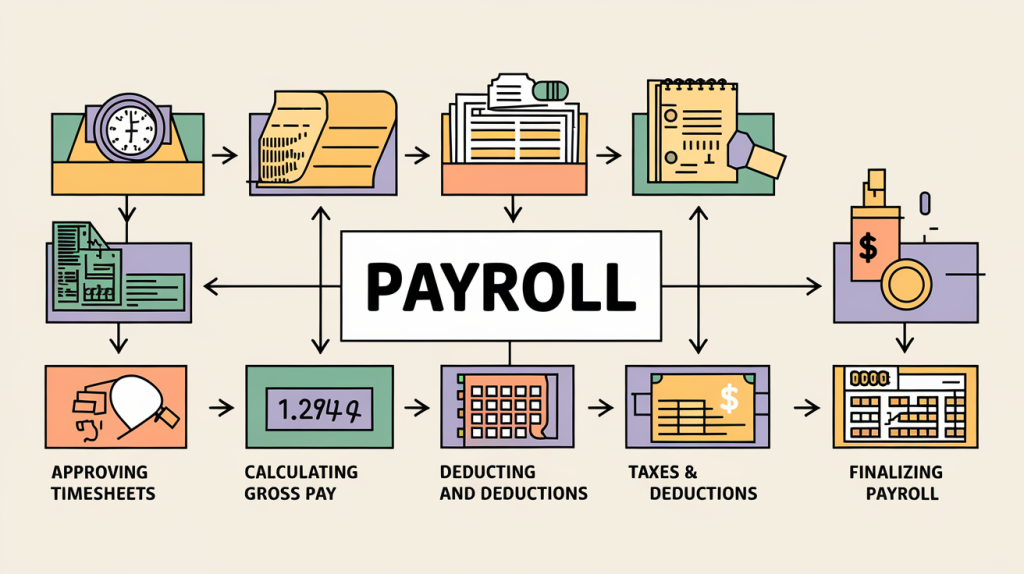

Why Box 1 Is Your Payroll GPS

Box 1 is not just a field on a form; it’s a critical element in your payroll process. It’s where taxable wages meet tax compliance, ensuring that employees and the IRS are on the same page. Think of it as the GPS guiding your payroll system—if the inputs are off, the journey is riddled with detours. When Box 1 is done right, it ensures seamless tax filing, employee satisfaction, and protection from IRS scrutiny. Let’s chart the course to success together.

What Is Form W-2 Box 1?

At first glance, Form W-2 Box 1 might seem like a simple reflection of wages, but it’s much more nuanced. While gross wages include all earnings before deductions, Box 1 focuses solely on taxable wages. This includes only the amounts subject to federal income tax, excluding specific pre-tax deductions and exempt earnings.

For the IRS, this number is vital—it determines how much tax an employee owes and serves as the foundation for audits and compliance checks. A miscalculation here doesn’t just impact payroll; it can snowball into larger issues with the IRS and employees alike.

Key Analogy: Think of gross wages as the pantry stocked with all ingredients and Box 1 as the final dish, prepared with only the taxable items that qualify for reporting.

What Gets Included in Form W-2 Box 1?

Box 1 isn’t just a sum of wages—it’s a curated list of what qualifies as taxable income. Here’s what makes the cut:

- Salaries and Wages: This is the base layer—your employees’ regular pay, whether hourly or salaried.

- Overtime and Bonuses: Supplemental earnings, like overtime and holiday bonuses, also belong here. These are common yet often overlooked in manual payroll systems.

- Taxable Fringe Benefits: Certain perks, such as gym memberships, transportation stipends, or wellness bonuses paid by the employer, are considered taxable and must be included in Box 1.

- Cash Awards and Prizes: Performance incentives, such as gift cards or cash bonuses, are treated as income and need to be reported.

Each of these inclusions reflects the wide array of taxable benefits and earnings employees may receive, and knowing what qualifies is key to ensuring compliance.

What Stays Out of Box 1?

Just as important as knowing what goes into Box 1 is understanding what stays out. Certain payments and benefits are exempt from federal income tax and don’t belong here:

- Pre-Tax Contributions: Employee contributions to retirement accounts (like 401(k)s) or health savings accounts (HSAs) are excluded from Box 1 calculations. In other words, these pre-tax benefits are deducted before determining taxable wages.

- Non-Taxable Fringe Benefits: Employer-paid premiums for health insurance, contributions to employee assistance programs, or life insurance premiums often remain outside Box 1. This means that these benefits are not taxed as part of the employee’s income.

- Reimbursed Business Expenses: Properly documented reimbursements for work-related expenses, such as travel or client lunches, maintain their tax-free status and don’t count towards taxable income. For instance, an employee’s travel reimbursements that follow IRS guidelines would not be included in Box 1.

Understanding these exclusions helps employers ensure accurate reporting while maximizing the tax benefits available to employees.

Top Employer Mistakes and How to Avoid Them

Even the most experienced employers can stumble when handling Box 1. Here are common mistakes and practical tips to avoid them:

- Mixing Pre-Tax and Post-Tax Contributions: Misclassifying benefits is one of the most frequent errors, often leading to inflated or understated taxable wages. Automating payroll deductions can prevent such mix-ups.

- Neglecting Taxable Fringe Benefits: Overlooking smaller items, like employer-paid parking or commuter benefits, can lead to underreporting taxable wages—a red flag for audits.

- Improper Tip Reporting: For businesses in the service industry, tracking and reporting tips accurately is essential to meet IRS guidelines. Failure to do so can lead to penalties.

Pro Tip: Conduct regular payroll audits and use robust payroll software to ensure compliance and reduce errors.

Streamlining Payroll: Why Automation Matters

Payroll is an intricate dance of calculations, deductions, and compliance updates. Relying on manual processes is not only time-consuming but also prone to costly errors. Automation can transform payroll management, reducing complexity while ensuring accuracy.

Benefits of Automation:

- Accurate Deduction Tracking: Automated systems differentiate pre-tax from post-tax benefits seamlessly, reducing manual oversight.

- Real-Time Tax Law Updates: Stay compliant with ever-changing regulations without breaking a sweat.

- Efficient Reporting: Automation enables you to generate accurate, ready-to-file W-2 forms in minutes.

Imagine This: Instead of wrestling with spreadsheets, you’re spending more time driving your business forward while your payroll system handles the heavy lifting.

Why Box 1 Accuracy Builds Trust

Payroll isn’t just about numbers—it’s about trust. Employees count on their paychecks to be accurate, and errors in Box 1 can create headaches during tax season. Worse, mistakes can erode trust, leading to dissatisfaction and morale issues.

When employers prioritize accuracy in payroll, they send a clear message: “We care about getting it right.” This fosters goodwill and strengthens relationships between employers and employees.

Key Takeaway: Accurate Box 1 reporting isn’t just about IRS compliance—it’s about preserving the integrity of your workplace culture.

Making Box 1 Work for You

Box 1 is more than a field—it’s a reflection of your commitment to compliance, precision, and employee satisfaction. By mastering its complexities, you ensure smooth tax filings, avoid penalties, and build trust with your workforce.

Ready to simplify payroll and improve accuracy? It’s time to take action. Invest in robust payroll software, seek professional guidance when needed, and audit your processes regularly. The effort you invest today will save you countless headaches tomorrow.

Start transforming your payroll process now. Get in touch with a payroll expert or explore automation tools that align with your business needs. Your employees, your compliance team, and your bottom line will thank you.

FAQs

Let’s tackle the most common questions about Box 1:

What’s the difference between gross wages and Box 1 wages?

Gross wages include all earnings before deductions, while Box 1 reports only taxable wages after accounting for pre-tax contributions and exempt benefits.

Are bonuses included in Box 1?

Yes, all bonuses, whether seasonal or performance-based, are taxable income and must be reported in Box 1.

Do pre-tax health benefits count towards Box 1?

No, pre-tax contributions to benefits like health insurance plans or FSAs are excluded from Box 1.

How do I ensure accuracy in Box 1 reporting?

Use payroll software or consult professionals to automate calculations and stay up-to-date on tax law changes.

What happens if I make an error in Box 1?

Errors can lead to IRS penalties, necessitate W-2 amendments, and complicate employees’ tax filings.

Can fringe benefits be excluded from Box 1?

Only non-taxable fringe benefits, such as employer-paid health premiums, are excluded. Taxable perks like gym memberships or transportation stipends must be included.