Everything you need to know!

SECURE Act 2.0 may make it more affordable to provide retirement

plans. Signed into law in December 2022, it adds 90+ provisions.

Here are some very important ones:

- Additional tax credits may help businesses offset the cost of offering a retirement plan.

- Auto-enroll is required for new plans started after 12/29/22, beginning with the 2025 plan year.

- Small financial incentives may be offered to employees to sign up for retirement plans.

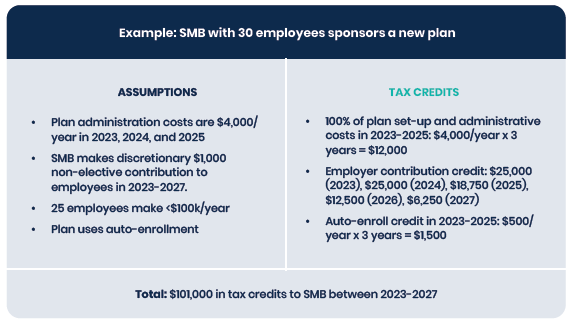

Expanded SECURE 2.0 Act small business tax incentives

The original SECURE Act created significant tax benefits for small businesses. SECURE 2.0 only

expands on these incentives.

- Doubles tax credits for new plans:

Businesses with 50 or fewer employees may

be eligible for a tax credit to cover 100% of plan

start-up costs, capped annually at $5,000 for

three years. Businesses with 51-100 employees

may be eligible for a tax credit to cover 50% of

plan start-up costs, capped annually at $5,000

for three years.

- Adds new credits for employer contributions:

Businesses with 50 or fewer employees may

receive a new tax credit based on a percentage

of employer contributions, up to $1,000/employee

for those making less than $100,000. Employers

with 51-100 employees qualify for a phase-in

credit.

- Expands eligibility for the start-up tax credit:

Start-up tax credits are extended to employers

based on the year they join existing multiple

employer plans (rather than only if they join

a new plan).

- Maintains tax credit for using auto-enrollment:

The tax credit of $500 per year for the first three

years of electing auto-enrollment is still available.

As always, if you have any questions please contact your Client Service Representative.