Payroll Bank Account Fraud is creeping into businesses like a wolf in a suit, slick, silent, and ready to pounce. And if you’re still relying on outdated systems or trusting an email with a smiley face at the end, you’re setting yourself up to get bitten.

Let’s break down exactly what’s going on and how to build a proper fortress around your team’s pay.

The Enemy: What You’re Actually Up Against

This isn’t about hackers in dark basements anymore. These criminals are organized, strategic, and they sound just like your Finance Director after two coffees.

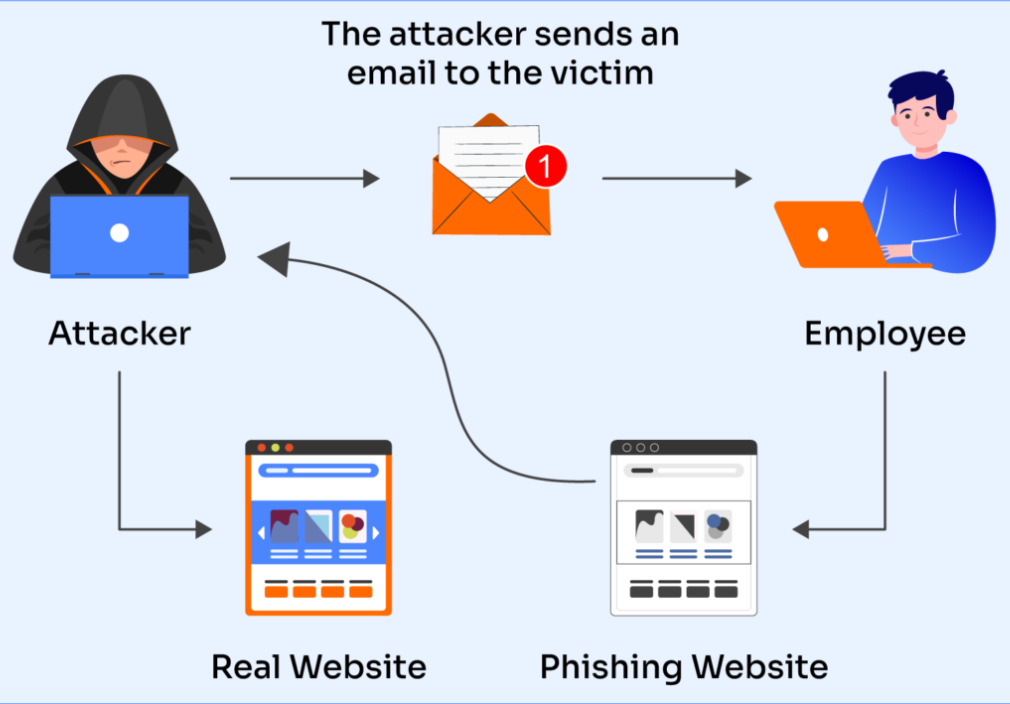

Phishing & Social Engineering

Attackers craft believable messages posing as executives or colleagues. They study internal language, timing, and workflows to hit when teams are busiest. These emails often bypass basic filters and hit payroll, HR, operations or the people who move money.

Spoofed Emails & Copycat Domains

They register domains one character off yours, clone branding, and even forward real email threads. Everything looks normal. One wrong click gives them access to systems, funds, or sensitive data.

This is where DNS (Domain Name System) and DMARC (Domain-based Message Authentication, Reporting and Conformance) step in. DNS is like the internet’s address book. It tells your emails where to go and who they’re coming from. DMARC, on the other hand, acts like a digital doorman, it checks that the email really came from your business and wasn’t spoofed. Without it, anyone can impersonate your brand with frightening accuracy. And most small to mid-sized firms don’t even have it set up.

Compromised Employee Accounts

They steal login credentials through phishing or malware, then quietly log in and observe. Using genuine inboxes, they send fraud requests that appear completely legitimate.

MFA (Multi-Factor Authentication) helps here. It means requiring more than just a password to get in. This additional step could be a text code, an authentication app, or a fingerprint. It’s like adding a second lock to your front door. But even that isn’t bulletproof.

Attackers now use session hijacking, where they sneak in by intercepting your login session after you’ve already authenticated. Imagine someone grabbing your hotel keycard right after you check in. You’re in the room, but now so are they.

The Shield: Protecting What You’ve Built from Payroll Bank Account Fraud

You wouldn’t leave your house unlocked in a dodgy neighborhood. Don’t leave your payroll wide open either.

1. Always, Always Verify Bank Changes

Email is not verification. Always confirm payment details by phone using a trusted number. No exceptions. Get physical proof such as a bank letter, a void check or a secure download from the bank’s portal. If there’s no proof, the change doesn’t happen.

2. Strengthen the System Against Payroll Bank Account Fraud

One person initiates the change. Another approves it. Clear separation reduces blind spots. HR and payroll must operate independently. Shared roles create risk. Treat access like access to cash. Only the people who need it should have it.

3. Bulletproof Your Tech Stack

Multi-factor authentication is essential. Apply it everywhere. Restrict payroll access to essential users only. Set alerts for logins from unfamiliar devices, unexpected hours or unknown locations. Audit your logs weekly to catch anything suspicious early.

4. Train Like You Mean It

Train staff to recognise red flags like urgency, unusual requests and messages that feel slightly off. Make training a regular habit, not a one-off event. Build a culture of vigilance. Never allow shared logins. They destroy traceability and kill accountability.

5. Review Like You’re Broke

Reconcile accounts often. These reconciliations are not just for catching fraud they also help ensure tax and withholding accuracy. Watch for two employees using the same bank account. Question payments going outside your usual geographic footprint. Investigate high bonuses or pay rises that weren’t approved. Numbers tell stories. Read them closely.

Stay Vigilant & Stay Protected

Proactive prevention is key to avoiding payroll bank account fraud. By verifying bank changes, improving internal controls, securing your systems, and training your team, you protect both your finances and your workforce’s trust.

Need a Payroll Bank Account Fraud Risk Assessment?

Here’s the deal: fraud is rarely about tech. It’s about people being too busy, too trusting, or too lazy to check. So fix the people part first. Build systems that assume someone’s trying to game them because they probably are.

Protect your team’s money like it’s your own. Because when payroll bank account fraud hits, the money vanishes but the trust takes years to rebuild.

If you want help setting this up, contact us today to schedule a review. PayDay can show you how to turn your business into a vault. Smart, fast, and human-proof.